As an expat in Thailand, you might be wondering why you should obtain health insurance here.

While the cost of healthcare in the country is generally affordable, things can get expensive over time.

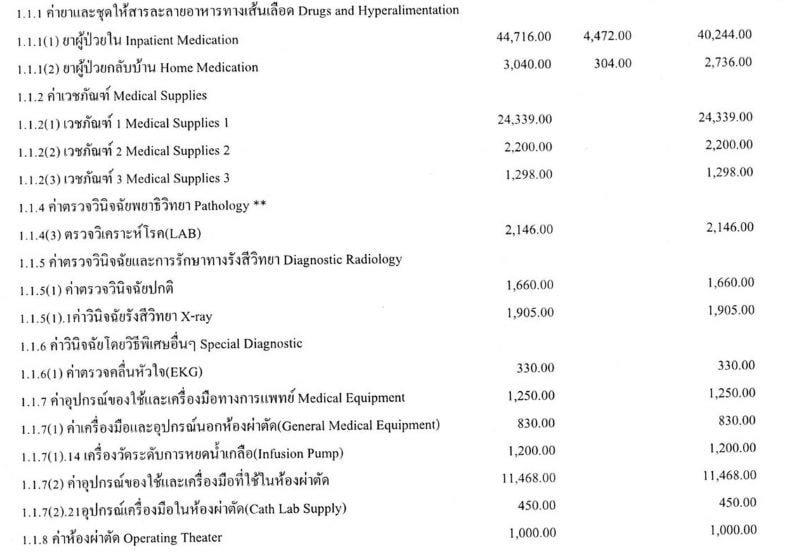

For example, I had nose surgery at Bumrungrad Hospital for a breathing problem. The surgery would have cost me around THB300,000. Instead, my health insurance paid for it.

Also, recently a friend of mine had meniscus surgery on his right knee at Bangkok Hospital. The whole treatment cost over THB200,000. And his insurance paid for it as well.

Aside from worry-free surgeries, having insurance will also let you go to a good private hospital without thought.

But because buying health insurance isn’t only about finding the cheapest plan on the market, you want to make sure you get a plan that actually covers you when the time comes.

Saving myself — and you — some time in choosing an insurance company is the reason that I’ve written this guide on the crucial points of health insurance for expats in Thailand.

If you want to skip the article and get right to my recommendation, check out Cigna Global. It offers comprehensible and flexible expat health insurance plans. Even its basic plan comes with a US$1,000,000 annual limit – sufficient for your life in Thailand.

"*" indicates required fields

Disclaimer: This article may include links to products or services offered by ExpatDen’s partners, which give us commissions when you click on them. Although this may influence how they appear in the text, we only recommend solutions that we would use in your situation. Read more in our Advertising Disclosure.

Contents

- Insurance Options

- Expat Health Insurance

- Local Health Insurance

- Social Security

- Universal Health Coverage

- Travel Insurance

- Health Insurance for Retirees

- Best Health Insurance Company

- Mandatory Insurance for Retirement Visa

- COVID-19 Coverage

- Health Insurance from Your Home Country

- Insurance Plans Explained

- Paperwork

- Finding the Best Insurance Plan

- Compare Thai Health Insurance Plan

- Brokers

- Frequently Asked Questions

- Insurance Guide in Other Countries

- Now, on to You

Insurance Options

There are six common health insurance options for expats coming to or already living in Thailand:

- expat insurance

- local insurance

- group insurance

- social security

- universal health coverage

- travel insurance

Each option has its own pros and cons. Let’s take a closer look.

Expat Health Insurance

Expat insurance are health insurance plans created specifically for expats by international health insurance companies.

It’s by far the most popular option for expats in Thailand for many reasons.

First, its coverage and limits are by far the most comprehensive, usually better than Thai policies.

Second, you get coverage internationally, not just in Thailand. This means you can keep the same plan even if you move to another country.

Third, international health plans are much easier to understand than Thai policies because they work the same way as those in your home country.

Fourth, many expat health insurance companies renew your policy despite your age. This is called a lifetime guarantee. However, you might want to get health insurance before you turn 55 years old. More on this later.

Lastly, international health insurance companies need to follow insurance regulations set in place by the United States and the EU, which are more strict than Thai insurance regulations.

This means you’re less likely to be kicked out of your plan or experience significant premium increases just for making a claim.

Expat Health Insurance Coverage

Expat health insurance covers a majority of healthcare in full as long as it’s under your annual limit, including:

- ICU stays

- cancer treatment

- evacuations

- surgery costs

- medication

- hospital rooms

- nursing fees

However, expat health insurance companies may have separate limits for certain minor treatments, such as:

- out-patient treatment

- MRIs

- home nursing

- physiotherapy

- acupuncture

When it comes to outpatient treatment, some expat health insurance plans offer annual limits and others offer plans that limit the number of visits you can make per illness.

Expat health insurance usually comes with worldwide coverage, excluding the United States. There are plans that do cover the United States, but the premium is going to be more expensive.

Many plans also come with home coverage. This means you can fly back to your home country and get treatment there. This is useful if you want to be treated in familiar surroundings or have your family around.

The overall coverage you get with expat health insurance, even with a basic plan, is enough for expats in Thailand.

Expat Health Insurance Options

You have several expat health insurance options in Thailand.

First, Cigna Global is generally recommended. Even its silver plan comes with a US$1,000,000 annual limit, which is enough for getting healthcare in Thailand.

You can customize the plan to suit your needs too. For example, you can choose whether you need coverage in the United States, OPD treatment, medical checkups, and more. Cigna also has plans for retirees and it doesn’t apply any age limits.

It’s also easy to get pre-authorization with Cigna. People have reported that their cases are approved on the same day after one phone call.

Other major players in the market include:

- GeoBlue – known for U.S. coverage

- Now Health – affordable plans but can get more expensive after making claims

- Foyer Global Health – have unlimited coverage limits

- April International – affordable plans with low annual limits, but it can take five to 15 working day for pre-authorizations

Cigna’s expat health insurance plans cover every important thing you need as an expat in Thailand.

There are also plans from William Russell, Aetna, Passport Card, and much more. You can look at our expat health insurance comparison page for a side-by-side comparison.

Expat Health Insurance Disadvantages

Expat health insurance isn’t perfect. There are still certain disadvantages, including:

- Premiums: Usually the most expensive option for health insurance in Thailand. You can expect to pay at least US$1,000 a month even for the most basic plan.

- Claims: Making a claim isn’t as easy as doing so through local insurance. For out-patient treatment, you may need to pay out-of-pocket first and make a claim later.

- Support: Expat health insurance companies may not have an office in Thailand. To contact them, you may need to make an international call or go through their app.

- Disputes: If you have a dispute with an expat health insurance company, you might not be able to pursue your claim in Thailand. And disputes overseas will be a lot harder to manage. As far as I know, you can dispute claims with local insurance companies through the Office of Insurance Commission (OIC) without the need to hire a lawyer in Thailand.

To avoid these disadvantages, you should buy expat insurance from a credible company. While premiums can be high, you’ll have less problems with making claims, getting support, or settling disputes.

However, it’s still a good idea to read your insurance policy in detail to understand exactly what you’re getting. Based on my observation, many disputes come from people trying to make a claim on what isn’t covered in their plans.

Where to Get Expat Insurance

You can buy expat health insurance through two methods:

- contact the health insurance company directly

- use an international insurance broker such as International Citizens Insurance

By using International Citizens Insurance, you can get instant quotes for the leading expat health insurance plans mentioned above and ask its international brokers any questions you might have.

Or you can fill out our health insurance form to get advice and quotes from our partner health insurance brokers.

Keep in mind, though, that you can’t get expat health insurance from a broker in Thailand.

One of the main reasons is that the OIC only allows brokers in Thailand to sell local health insurance. Otherwise, they might have issues with their insurance licenses.

Local Health Insurance

You can find local health insurance from private health insurance companies in Thailand. Local health insurance is also provided by international insurance providers that have branches in Thailand, including AXA, Allianz, and AIA.

Banks in Thailand also offer health insurance. But most of the time, it’s an add-on package for life insurance. This type of add-on insurance usually isn’t available to expats because it’s hard for expats to get life insurance from a Thai bank.

Agents and brokers offer local health insurance, and local insurance is what you see advertised in the Thai media.

One big upside to having local health insurance is that hospitals regularly deal with local companies. You show your card when you register, and the hospital and insurance company take care of the rest.

You also won’t have to fill out and send in so much paperwork when using local health insurance.

However, you have to visit a hospital in the insurance company’s network. If you go to a hospital or clinic outside of the network, you can file a claim and get reimbursed.

Your insurer updates the list of hospitals in its network every year. You can also find this list in your insurance policy.

Here’s a summary of local Thai health insurance:

- There are various types of local health insurance available in Thailand. The plans come with benefit limits (more on this in the next section) and work the same way as expat insurance. Some even come as an add-on to life insurance plans.

- Local health insurance tends to be more affordable than expat health insurance but comes with lower coverage limits.

- One of the great things about local health insurance is that the company pays the hospital directly, so you won’t need to make a claim.

Local Health Insurance Coverage

The coverage for most private local health insurance plans works differently than in the West. Instead of annual limits, they come with benefits limits.

What you find when browsing for local health insurance plans is a list of coverage limits on different hospital expenses, such as:

- doctor fees

- scans

- hospital rooms

- surgery fees

- ICU stays

For example, your plan may have a limit of one million baht but might cap surgical fees at THB100,000, hospital bills at THB80,000, and room and board at THB8,000 per day.

So, depending on how much a hospital charges for each procedure, you may need to pay out of pocket.

In addition to benefit limits, you can find local health insurance plans that come with sickness limits, or the total amount they will pay per sickness, which is becoming more popular.

Some local health insurance companies are even starting to provide plans with annual limits like expat health insurance.

Please note that even local plans may come with annual limits or limits per sickness. They may still have a cap on doctor’s fees, hospital rooms, and hospital fees. So, carefully read your plan.

Local Health Insurance Options

Previously, the health insurance market wasn’t that big in Thailand because the local insurance market was mainly for car insurance.

Back then, health insurance was only available as part of life insurance from companies like AIA. The whole situation was quite the same as health insurance in Indonesia at the moment.

However, the health insurance market in Thailand is growing and you now have a lot of options.

One private local health insurance company I often suggest is Luma.

The plan is mainly for expats and works similar to expat health insurance.

It comes with annual limits of THB5 million to THB50 million, which should cover even the most expensive treatment in Thailand. They’ve also partnered with many top-tier private hospitals, including

- Bumrungrad

- Bangkok Hospital

- Samitivej

You can also choose to get international coverage through Luma.

Other major players in the local insurance market include:

- AXA

- AIA

- LMG

- Muang Thai

- Aetna, which has been taken over by Allianz

You can easily compare these local plans and buy them directly from a local broker named Mister Prakan.

Many banks in Thailand also offer health insurance. But it’s usually accident insurance or life insurance rather than a comprehensive package.

Local Insurance Disadvantages

Local coverage can also be limited in terms of:

- the amount of coverage when compared to local coverage in other countries

- your age (meaning a few will kick you out when you reach 75)

- exclusions (don’t get into a motorcycle accident)

- coverage area (you can’t keep your plan when moving out of Thailand)

There is a wide range of local private health insurance plans with different coverage limits. Some plans might not be comprehensive, but they are affordable.

They can also be more expensive than expat health insurance in terms of coverage per premium.

For example, you can pay THB42,000 per year for a local plan but it pays out a maximum of THB500,000 per sickness. On the other hand, expat health insurance can be slightly more expensive but you get much higher coverage limits at THB35,000,000 per year, in addition to international coverage.

In addition, local health insurance companies follow Thai insurance regulations, which can be much less strict than regulations in the West. Sometimes, they may raise the premium significantly after you make an expensive claim.

Because of this, local private health insurance can be a good option for those on a limited budget and know exactly what they want.

If you get good private local health insurance, you won’t have to worry about going over your coverage limits. However, premium can be fairly expensive as well.

Where to Get Local Health Insurance

Similar to expat insurance, you can get local health insurance directly from the insurance company’s website.

Since most customers are Thai, English-speaking customer support might not be as good as you expect, unless you go through a provider that targets expats, such as Luma.

Alternatively, you can buy from a local health insurance broker.

I recommend Mister Prakan. It’s a one-stop solution that lets you shop around for local plans and compare them side-by-side. You can also talk to one of its brokers for further details.

Group Insurance

Group insurance can be separated into two types:

- group insurance for families

- group insurance for business

If you buy family group insurance, you can get a discount if you insure three or more family members. Discounts range from 5 percent to 10 percent.

The main disadvantage of group insurance is that when the number of people in your plan falls short of the minimum requirement, you might not be able to renew the policy.

This can be a problem for aging people with medical conditions because they won’t be covered for medical treatment anymore.

Another option is group insurance for business. If you run a company in Thailand, you can buy group insurance for you and your workers from local health insurance companies.

They are cheaper than individual plans. And you can use them to decrease your business taxes. Based on my observations, it might not be comprehensive enough if you want to use them as your main health insurance. But it’s a nice benefit for your workers.

The amount of out-patient treatment coverage is what grabs workers’ attention the most.

On the other hand, if you have a team or remote workers, you can’t get a group plan from local providers. You need to get international plans instead.

Remote Health can be a good option. It’s international insurance mainly for digital nomads and remote workers. It comes with worldwide coverage and an annual limit of US$1,500,000.

It’s much more comprehensive than local plans but more expensive as well.

For more information, read our group health insurance guide.

Social Security

If you work in Thailand legally, you’ll have insurance through Social Security.

Your employer will deduct 5 percent of your gross salary, but no more than THB750, for Social Security every month.

With Social Security, you can get medical care and medicine for free by going to your designated Social Security hospital with your Social Security card and passport.

You can’t pick any hospital to visit on Social Security, but you can pick three that you prefer out of a network. You have over forty hospitals to choose from in Bangkok.

Social Security basically gets you free medical treatment. But there are concerns about the quality and waiting times because of the long queues at the hospital.

Many expats we talk to do not use Social Security because they don’t want to waste the entire day at a hospital.

You can find out more in our guide to Social Security in Thailand.

Universal Health Coverage

Thailand’s universal health coverage is known as the 30-baht scheme.

With this scheme, you can pay THB30 to get full treatment at your designated hospital.

However, we won’t go into a lot of details here because the 30-baht scheme isn’t an option for expats. It’s only available to Thai citizens who don’t have Social Security, or public insurance for government officers.

Find out more: Healthcare System in Thailand: A Guide for Expats

Travel Insurance

Some insurance companies offer short-term coverage in the form of travel insurance.

Short-term coverage can range from a few weeks to a few years. You can get travel insurance if you apply from your home country, but not when you’re in Thailand.

Prices are a lot more attractive than what you’d get for long-term coverage.

By taking out travel insurance coverage, though, you’re facing two possible problems:

- Travel insurance companies don’t have to deal with expensive long-term care. If you need long-term care they could repatriate you and hand you off to the Social Security system in your home country.

- Travel insurance companies tend to offer emergency healthcare coverage. This means you’re covered for accidents or illnesses that need immediate care.

You should get travel insurance for short-term stays or vacations in Thailand.

Other than that, it makes sense to get long-term health insurance so you’re covered for severe medical problems.

Read our guide to travel insurance for more information.

Health Insurance for Retirees

Health insurance options for retirees are quite limited since many insurance companies may not accept new applicants if they’re older than 60. It’s also getting harder to find a company that accepts someone who’s older than 70.

If they do accept you, premiums are going to be very expensive, which can cost easily over THB100,000 a year.

There are certain insurance companies, both local and international, that have plans for retirees.

Cigna Global, for example, has a senior plan that’s specifically created for retired expats living abroad.

In addition to international coverage and an annual limit of US$1,000,000, what’s great about this plan is that it doesn’t have any age limits. You can sign up at any age and keep renewing your plan.

Cigna also covers outpatient treatment and medications for pre-existing conditions such as hypertension, type-2 diabetes, arthritis, and more.

In addition to Cigna Global, you can check retiree plans offered by local insurance providers. These plans are mainly to qualify for a Thailand retirement visa. So, the coverage limit is subject to change, depending on visa requirements.

It’s more affordable than Cigna Global but not as comprehensive. For example, the coverage limits are much lower. And it tends to come with a high deductible, at least THB100,000.

If you’re interested in this option, check out Luma Long Stay Care.

Best Health Insurance Company

There are over 100 insurance companies that offer health insurance for expats in Thailand. So, we couldn’t mention them all in this guide.

Also, each company has different pros and cons. Some plans may be more expensive than others but come with better coverage or easier claims processes. Some companies may have a great plan on paper but cancel your coverage if you make too many claims.

That said, here’s a list of insurance companies in Thailand that are popular with expats. Some of them are more popular than others, so let’s take a look.

Cigna Global

Cigna Global is one of the largest health insurance companies. Its plans are popular with expats not just in Thailand but around the world.

Key Takeaways

- Good health insurance plan overall for expats in Thailand

- Comes with annual coverage limit of THB35,000,000

- Comprehensive overall coverage

- Many ways to customize your health insurance plan

- Good senior plan, which in our opinion is one of the best in the market for retirees

- Easy one-day claims process

- Slightly more expensive than other plans

Cigna offers flexible plans. You can customize your coverage, optional coverage, areas of coverage, and much more.

Cigna’s basic plan comes with THB35,000,000 in coverage, which should be enough for expats in Thailand.

Recently, it released its Cigna Close Care plan, which is another affordable option. But this plan only comes with THB15,000,000 in coverage. And you can only choose one country to get coverage in.

Luma

Luma offers many local health insurance plans. One of its main plans for expats in Thailand, Hi5 Health Insurance, comes with THB5,000,000 in coverage. While the coverage amount is lower than Cigna’s, it’s still enough.

Key Takeaways

- More affordable option than Cigna but still comprehensive

- Sufficient THB5,000,000 coverage limit

- Direct billing with many of Thailand hospitals

- Can also get coverage for other Asean countries (Zone C plan)

- Can increase your coverage limit to THB50,000,000

If you want more coverage, they also have a PRIME tier, which comes with THB 50,000,000 in coverage per year.

They have many options for areas of coverage. For expats in Thailand, Zone C is the most appropriate option. However, they do not cover you in the following Asian countries:

- Japan

- Hong Kong

- Singapore

- Taiwan

Also, to enjoy the full benefits of direct billing, you must visit a hospital that operates within their network. Most of these hospitals are located in Bangkok, but they do work with hospitals in other provinces.

Foyer Global Health

This might be the first time you’re hearing about Foyer Global Health. However, this health insurance company offers great plans for expats.

Key Takeaways

- Health insurance plan comes with outpatient coverage, which is hard to find with other providers

- Unlimited coverage

- Can contact them in advance and have them pay the hospital directly

- Located in Luxembourg, so contacting them from Thailand might not be convenient

- Overall price is good for what you get

The first time we found out about Foyer was from our partnered insurance broker in Bangkok. He insures himself through Foyer.

He had knee surgery in Bangkok Hospital and Foyer paid for all the costs. So, it’s another good option for expats in Thailand.

One good thing about Foyer is that its basic plans come with outpatient coverage. This is hard to find from health insurance providers that cover expats in Thailand.

However, since it’s from Luxembourg, setting up direct billing in Thai hospitals might be hard. This is especially true for outpatient care.

GeoBlue

If you are from the U.S., you might already be familiar with GeoBlue. It’s a partner of Blue Cross, the largest health insurance network in the U.S.

Key Takeaways

- One of the best plans for those who need U.S. coverage

- More affordable than other plans that offer the same U.S. coverage

- Since it’s a partner of Blue Cross, you get access to their vast U.S. network

- If you don’t need U.S. coverage, it might be better to buy another plan

GeoBlue is usually popular with U.S. expats who need coverage in the U.S. After all, GeoBlue tends to be cheaper than other health insurance companies. You also get access to its massive U.S. health network.

However, in our opinion, GeoBlue’s health insurance plans are not that attractive if you don’t need U.S. coverage.

LMG

LMG have two local health insurance plans for expats: Long Stay Visa Plus, and Long Stay Visa Plus Premium Plan US$100,000.

Key Takeaways

- Affordable health insurance plan for expats in Thailand

- Many plans available for those with different coverage needs

- Plans for those getting a Thai retirement visa

- While it’s affordable, overall coverage can be less than other plans

Luma can be a good option for retirees who need health insurance to meet their visa requirements.

These plans are available to anyone younger than 80 and can be renewed until you are 100 years old. Premiums are also affordable than other plans for anyone older than 60.

The main disadvantage is the high deductible, which starts at THB100,000.

So, LMG is good for expats who need health insurance for visa purposes or retirees who need coverage for major care.

To get a plan from LMG, it’s a good idea to talk to a local broker so that you understand exactly what you’re getting. We recommend Mister Prakan. You can also explore other local Thai insurance plans with them.

Mandatory Insurance for Retirement Visa

As of November 2023, you officially need to have health insurance if you want to retire in Thailand with a retirement visa.

It can be either offshore insurance or local insurance, as long as it has at least 400,000 baht IPD and 40,000 baht OPD coverage.

Luma Long Stay Care is a good plan in this regard. In addition to being affordable, they also follow the new regulations for the retirement visa closely to make sure that their plans pass the requirements.

The plan is also available for those who are younger than 79 and renewable until you are 90 years old.

You should note that insurance plans for the retirement visa in Thailand come with a high deductible of 20,000 baht to 200,000 baht. You may also need to do a health check-up if you are over the age of 65.

Since the regulations of health insurance for the retirement visa have been changing regularly, it is highly recommended to do your own research again before buying it.

This said, you’ll probably find that getting your health insurance in place before you actually need it may be a good investment (especially since serious issues may not only crop up without prior warning but also then prevent you from being able to obtain coverage in the future due to a pre-existing condition or the high likelihood of this recurring).

COVID-19 Coverage

If you already have health insurance, chances are that you are already covered for COVID-19.

If you don’t, you can check out insurance plans that are mentioned in this article. All of them, including LUMA and Cigna Global, come with COVID-19 coverage.

In case you want travel insurance, you can check out Mister Prakan.

You get the same coverage and coverage limits for COVID-19 as other diseases.

Please note that COVID-19 coverage usually comes with a 14-day waiting period.

Health Insurance from Your Home Country

If you already have health insurance, check your area of coverage before you come to Thailand.

If you have expat health insurance from an international provider, chances are that it might already cover you in Thailand, so you can keep the same plan. If your plan doesn’t cover you in Thailand, contact the company. They may be able to make some changes to your plan so you can have coverage in Thailand.

On the other hand, if you have local or public health insurance, including medicaid and medicare, chances are that it won’t cover you in Thailand.

And you can forget about health insurance provided by credit card companies. Most of the time, it only covers you for personal accidents in which you lose a limp.

Alternatively, you can check out health insurance in your home country before flying to Thailand. It can be cheaper than buying health insurance in Thailand and even cover pre-existing conditions. But the main limitation is that it’s only available for your first few years in Thailand.

As far as I know, only German and Swedish nationals have this option.

Insurance Plans Explained

You’ll find the price of health insurance and the rough description of what’s included are just the tip of the iceberg.

You’ll have to read the fine print to find out about:

- exclusions

- pre-existing conditions

- cancellations or non-extensions

- areas of coverage

- coverage limits

- age restrictions

- premiums

- optional coverage choices

Let’s take a closer look at what’s excluded.

Exclusions

Here are some exclusions you’ll find in every insurance plan:

- alcoholism

- disasters and terrorism

- motorcycle accidents

- sexually transmitted diseases

- sports

But one important exclusion varies from insurer to insurer:

- chronic diseases

You should take a good look at the fine print. Here’s what to watch out for:

Alcoholism

Insurers exclude alcoholism under all plans. There are also selective exclusions if you get hurt under the influence of alcohol.

You’ll have to read the fine print to find out if this means no coverage for “drunken bar fights” or “for anything as long as a traceable amount of alcohol is in your blood.

I’ve heard of one insurance company who hired a private investigator to check if a patient who filed a big insurance claim was under the influence during the accident in question.

It turned out that he was. The insurance company refused to pay for medical care and the hospital kicked the patient out of the hospital.

Chronic Diseases

You won’t see this limit often. Most of the time, insurance companies exclude pre-existing conditions. But they cover any new conditions in full.

Some insurance companies might limit your coverage of chronic diseases. You should worry about this.

With outpatient department coverage, or OPD, chronic diseases cause some of the most costly claims.

Please note that the insurance company may no longer pay for chronic disease if, based on a doctor’s decision, further treatment will not improve the patient’s condition.

Disasters and Terrorism

Every insurance company excludes you from coverage if you take part in war or crime.

Some insurance companies might not offer coverage if you were a victim of a natural or man-made disaster.

Given the political protests and bombings that happen in Thailand every few years, make sure this isn’t the case with your plan.

Motorcycle Accidents

Some plans don’t cover anything motorcycle-related. Not good.

Buying health insurance in Vietnam is similar to Thailand in this regard. You’re likely to be on a motorcycle at some point.

Other plans are more lenient and won’t cover you only if you were driving without a license.

Then there are the tricky plans that exclude accidents involving both jaw bones, regardless if you wore a helmet or not.

You should read the fine print of this exclusion on insurance plans.

Good news is that if you are a passenger or hit by a motorcycle, you will be covered.

Thailand also has compulsory insurance known as Por Ror Bor that always covers road accidents. Read our car insurance article for more information.

Sexually Transmitted Diseases

Some insurers exclude coverage of sexually transmitted diseases, or STDs.

Others exclude it, unless you weren’t at fault. But the burden of proof may be on you.

Some insurance companies limit coverage costs for HIV treatment.

In any case, keep in mind that the majority of costs for the treatment of STDs are OPD. Unless you opt for OPD coverage, insurers won’t cover you for STDs.

Sports

You won’t find much coverage for taking part in professional sports, combat sports, and other high-risk activities such as paragliding.

If you compete or take part in a dangerous sport, check the exclusions for sports activities.

Some insurance companies exclude specific sports. Others describe the sports they exclude less clearly.

If you’re at risk for sports injuries, you’ll want your potential insurers to put into writing whether or not they’ll cover you.

Pre-existing Conditions

Pre-existing conditions are the biggest problem with health insurance plans.

You’ll often hear that insurance companies will review pre-existing conditions on a case-by-case basis or offer insurance excluding pre-existing conditions.

In my experience, that’s true for things like:

- rashes

- allergies

- injuries that don’t affect other parts of the body

- one-time occurrences from accidents

Insurers may refuse you coverage for serious injuries or illnesses that can lead to problems in the future.

As a rule of thumb, if your illness is a major reason you’re seeking insurance, they won’t accept you.

Beware of insurers that accept you and don’t check this until you make a claim. They’ll give you a false sense of security.

If you are older than 40 years old, it’s recommended to get a health check-up before buying a new health insurance policy.

You can use it as a proof if the insurance company won’t pay for your treatment by claiming that it’s a pre-existing condition.

Cancellations or Non-Extensions

Is the insurance company able to cancel the policy or refuse to renew it?

Avoid plans that allow insurance companies to cancel or refuse the renewal of your policy.

Because if you send in a lot of claims, get a chronic disease, or are sick when the renewal date comes around, expect insurance companies to do just that.

I had one reader email me who had that happen to him.

A broker sold him an affordable plan that seemed comprehensive. He found out it was an “annual plan” when the insurance company canceled it the moment he became too pricey for them.

The same thing also happened to my employee. A few years ago he had to get a cardiac Holter monitoring test.

Although the results showed that his heart was normal, the insurance company listed it as an exclusion and they didn’t cover costs related to cardiac arrhythmia for a year after that.

In other words, when my employee needed the insurance the most, the insurer walked away scot-free.

Area of Coverage

Are you covered when traveling to your home country and other destinations? If so, for how long?

Not a big deal really, since travel insurance can be had for cheap: As long as you don’t forget to sign up for it every time you go abroad.

Coverage Limits

You’ll find three types of limits in insurance contracts in Thailand: annual limit, sickness limit, and benefits limits.

Annual limits are quoted per year. Sickness limit and benefits limits are quoted per sickness.

Coming from Germany, the fact that a Thai insurance company would only repay me a certain amount was new to me.

In Germany, you’re either covered in full or you have to make a copayment—usually for dental work—and that’s it.

It doesn’t matter if you’re in a coma for ten years or more. What are they going to do? Stop treating you once you reach your limit?

Well, that’s what can happen to you in Thailand.

In Thailand, every private health insurance sold has a limit. If you’re new to the country, it’s a tough call to decide what amount of coverage is enough.

How Much Coverage Limit Should I Need?

So what limit should you choose?

To get a good idea, you can look at Bumrungrad Hospital.

They are one of the most reputable hospitals in Thailand and their prices match the quality of care and level of comfort they offer.

A few procedures cost more than 500,000 baht.

But the real heavy hitters for hospital costs are less-routine surgeries, along with the long-term stays in ICU due to a mishap or illness.

The most expensive case I’ve heard of involved heart surgery with a total hospital stay of six months. The cost for that came to 12 million baht.

He amassed that amount the first few weeks in the ICU, which clocked in at about 500,000 baht a day.

No broker I talked to knew of anyone who ran up more than 16.5 million baht in bills.

If I were to sign up for new insurance, I would aim for at least 15 million baht in coverage. For expat plans that would mean $500,000 in coverage.

On the lower end you should keep in mind what the Thai government deems minimum coverage. Thailand’s Social Security System has a coverage limit of 2 million baht.

In other words, that’s the healthcare coverage every 7-Eleven employee gets.

You don’t want to go below that.

Procedure-Specific Limits

Insurance companies limit specific procedures. Here’s an overview of common procedures and how much you’re limited to:

Organ Transplants

Some insurers have limits on donor costs for organ transplants. Now Health International’s WorldCare Excel plan limits them to $50,000.

I assume if a liver is too costly, they’ll pass and wait for the next, cheaper one?

Most limits are about the donor’s costs. I assume they want to avoid having the hospital bill them for ICU costs by the late donor.

In some cases, like with ACS, they refuse to pay for any donor costs.

HIV Treatment

This is a big topic in Southeast Asia. Lots of insurance companies leave it out if caught through sex. Some even exclude it outright.

Those that don’t limit treatment costs will put a limit on the maximum amount you can claim.

HIV treatment in Thailand isn’t too pricey because HIV medication is made here. But in the future you might not get coverage for more expensive treatments.

Pregnancy

I haven’t spent too much time looking into this limit for obvious reasons.

But to my knowledge pregnancy is an add-on, often with coverage limits and a 10-month waiting period before coverage kicks in.

Pregnancy coverage is usually only available on comprehensive insurance plans.

You can check out our post on having a baby in Thailand for more details and the costs involved.

Age Restrictions

The rule of thumb is that if you sign up before the age of sixty, you can find health insurance with lifetime coverage.

Once you turn sixty-five, it becomes harder to get comprehensive health insurance for people of retirement age.

If you are older than 70 years old, you will have very limited choices.

One reason for the de-facto age limit is that, on average, people spend 80% of their healthcare costs in the last five years of their lives.

Of course acceptance is just one part of it–the other is the premium.

Above the age of sixty, you won’t be able to find cheap insurance coverage. Insurance plans in Thailand don’t subsidize older age groups with premiums from younger members.

This means coverage at an advanced age comes at a much higher price than you’d pay back home.

It’s important that your insurance can’t cancel or refuse to renew your coverage.

You also want to watch out for any specified maximum ages.

Lots of companies with lower costing, local insurance plans specify an age at which coverage ends.

It might not matter if you’re thirty-three, but at fifty-five you need to take this into account.

Of course that doesn’t protect you from rising premiums, but that may be a lot cheaper than finding yourself without coverage after falling ill.

One insurance company you can take a look at is Luma Health. Their plans comes with:

- 5-million baht to 50-million baht limit

- coverage for cancer treatment

- medical evacuation

- a lifetime guarantee until you are 99 years old

The plan doesn’t cover any pre-existing conditions. But this is normal for health insurance companies.

Although the maximum age you can sign up is seventy, you should get it before turning fifty-five.

The premium rate for fifty-five year old males starts at 70,000 baht a year.

Or you can just check out Cigna Global. They have a plan for retirees that doesn’t have any age limit.

Cost

Cost or the premium is the clearest part of an insurance policy. It’s the fine print that’s trickier to get. But even though the premiums are stated, you should keep these things mind:

- payment terms

- deductibles

- medical inflation

- age groups

Payment Terms

A number of insurers have a surcharge for monthly payments.

Since your contract runs the full year anyway, you might as well pay in full.

Deductibles

Your premiums will be a lot lower if you agree to pay for the first thousand or two thousand dollars of healthcare each year yourself.

In practice, that means you won’t be able to claim anything but severe cases.

Make sure you keep receipts and file them by their deadlines. People forget about this because they don’t expect to have to pay for bills beyond their deductible—until they do.

An easier, more hassle-free choice that would get you the same results but much less paperwork would be to just opt out of OPD coverage.

What happens if you’re in an age group where the cost for insurance shoots up? You can add a deductible to lower your premium to an affordable level while keeping coverage for serious cases.

Medical Inflation

Medical inflation in Thailand is high. Most insurance companies say they’ll raise yearly premiums by less than 10%.

From my experience I’d say that the increases are a lot lower than that.

But you should keep this in mind for future budgeting. Your health insurance will go up 5% each year along with the increases that occur when you get older.

If you go with a local insurer, your plan may be significantly more expensive after you make an expensive claim.

Age Groups

Most insurance companies divide age ranges in groups of five years.

Every time you enter a new age group, your premiums will go up. In your twenties and thirties that doesn’t make much of a difference. But once you pass fifty, the increases can start to hurt.

You should compare current day rates and the rates your insurance is charging people who are five to ten years older than you.

Optional Coverage Choices

A few options are covered as add-ons. Skipping them lets you lower your premium as long as you’re okay with paying out of pocket.

Some of the optional coverage is:

- OPD

- dental

- medical evacuation

OPD

Going to a hospital in Bangkok costs anywhere from 700 baht to 3,000 baht in total, depending on the fanciness of the hospital, medications, and the doctor’s chosen medical field.

To give you an idea, Bangkok Hospital, one of the fanciest hospitals in Thailand, charges you around 2,000 baht per visit for a consultation fee, while general private hospitals usually charge around 500 baht to 1000 baht.

Medication is sold at a mark-up in the hospital itself. Mark-ups range from two to ten times the cost of a pharmacy.

If you buy medication at the hospital you could pay just as much as you pay to see the doctor.

Going to cheaper hospitals that don’t have free juice and a hotel-lobby-style waiting room would lower your OPD costs.

If you’re not living in Bangkok, the OPD facilities you’re going to use will be a lot cheaper unless you visit a branch of Bangkok Hospital.

A close second in why you might not want to bother with OPD insurance is the paperwork. A lot of people dread having to fill out forms, mail claims, and dispute rejections.

It’s frustrating to do that for a minor claim only to have it denied. You’re better off paying straight out of your own pocket.

You should also be aware of some insurance companies classifying certain procedures as OPD, even though you might spend a few days in the hospital.

This way they can refuse a claim unless you opt for OPD coverage.

In the end, I opted for OPD coverage because I feel the amount I overpay is worth the fact that I’ll never put off a hospital visit due to cost.

Call it a psychological effect.

Dental

Coverage for dental varies a bit. Some insurance companies make you co-pay or cover one routine checkup a year.

In my experience though, they’ve covered 100% of my dental costs for the minor claims I filed.

You shouldn’t pay more than 3,000 baht per year for regular checkups every six months even if you visit an international clinic like BIDC.

Most insurance plans you’ll find in Thailand will only include dental work as optional coverage. They also won’t cover cosmetic dentistry or dental implants unless it’s necessary such as you need to do it after having an accident.

But since the cost of dental care is lower, you shouldn’t worry about it too much.

Medical Evacuation

Some insurance companies offer medical evacuation as an add-on. The usefulness depends on where you live in Thailand.

Most competitive-priced plans won’t fly you to your home country, but to the next suitable hospital, which in most cases will be in Bangkok.

If you don’t leave Bangkok much or get travel insurance when you do, there’s little point in requiring medical evacuation.

The exception? If your limit is high, I imagine the insurance company might offer it themselves whether you picked it or not.

Flying you home might be cheaper for them than paying for an extended stay at a top-tier hospital in Thailand.

But don’t count on it.

Other Terms and Conditions

There may be other terms and conditions that can affect the viability of your insurance coverage.

Reading the conditions of your insurance contract is tedious. But think about how much you’ll be spending on this for the next five to ten years.

That should be worth setting aside an hour or two to go over the details of your plan.

We published a nice wrap-up on expat insurance terms and what they mean. You should check it out to get to know the language of insurance.

If in doubt, I suggest sending an email to your potential insurer, listing out what you’re concerned about, and trying to get some statement from your broker or insurance company that clarifies your question.

I’m not a lawyer or insurance expert and this isn’t legal advice, but I assume this should improve your position if it ever comes to a dispute.

Paperwork

When you take out insurance, you’ll have to think about the amount of paperwork involved. So let’s look at three common areas of insurance in which you’ll need to file paperwork:

- insurance applications

- prior authorizations

- denials of claims

Insurance Applications

Applying for insurance in Thailand is like applying in other countries. Each insurance company has its own survey.

Insurers will ask you questions about your past health and illnesses and if you lie about it, it might void your coverage.

Some companies ask if other companies have turned you down. If you think you’re at risk of getting turned down by some companies, apply for all of them at once.

This way they can’t deny you if you’re going to be turned down by another insurer.

Prior Authorizations

In some cases, insurance companies require prior authorization before getting hospital care. You can call them and do it via their apps. This is standard for any non-urgent visits to a hospital.

Some insurance companies also require prior authorization for more expensive OPD procedures like MRIs.

That tends to result in a back and forth between hospital and insurer and you waiting a day or two until the insurance comes through.

I’ve never heard of insurers refusing authorization, but I assume it does happen. Otherwise, why have it?

Anyway, it is still recommended to contact your insurance provider before going to a hospital.

In case it’s an emergency, go to a hospital and contact an insurance company when you can. Or ask your friend to do it.

Denials of Claims

What good is insurance coverage if your claim gets denied?

Pre-existing conditions are one of the most common types of claim denial. Sometimes, if you make a claim many times after getting health insurance for a few months, the insurance company may ask you to pay out of your pocket first until they can investigate your case and reimburse you later.

Many brokers said that another common reason for denials of claims come from clients not clearly understanding the coverage they get and making a claim on what isn’t covered on their plans.

So, read your insurance policy well.

Finding the Best Insurance Plan

When looking for insurance plans, don’t make the mistake of looking for the cheapest plan.

Instead, it’s better to look at:

- area of coverage

- coverage limits

- exclusions

- renewal guarantee

- company reputation

Area of Coverage

Does the plan cover you in Thailand or other countries as well? This is important for those who often move or travel to new countries.

Coverage Limits

How much is the plan’s coverage limits? And what are the limits of the benefits? Are they enough for your needs?

Exclusions

Are there exclusions that you should be aware of? Do you have a chronic disease or take part in activities that aren’t covered?

Renewal Guarantee

Are they going to let you go if you’re diagnosed with a chronic disease, make too many claims, or claim too much?

Company Reputation

Is the insurance company easy to deal with? Do they raise premiums every year by a large percentage? How about people’s experiences with them?

The plan suitable for you might not be the cheapest, but it’s better than getting a plan that doesn’t give you enough coverage when you need it.

Reading the fine print, looking at reviews from customers and talking to a good broker will help.

You can research suitable insurance plans by checking out:

- comparison websites

- brokers

Each of these methods have pros and cons.

Compare Thai Health Insurance Plan

Comparison websites let you search for insurance plans with filters and searches, rather than having to compare sales brochures and brokers’ Excel sheets.

You can also fill out medical surveys and apply online for plans.

In case you’d like to look into expat insurance plans, you can use a comparison service from International Citizens Insurance.

They are international brokers and can give quotes from multiple major offshore insurance companies at once.

If you have any questions or concerns, you can ask them for advice. They might be able to suggest a plan that you haven’t come across during your research.

Mister Prakan offers a comprehensive comparison of local health insurance plans in Thailand.

They are a licensed brokerage company in Thailand. They’ll allow you to do the initial research yourself, making it easy to compare plan benefits and costs online at your own pace before talking to one of their agents.

The website covers major insurance companies and:

- sorts them by price

- allows you to filter them by coverage level

- gives details about coverage limitations

- displays editorial ratings of each company.

They also act as a broker and have English-speaking staff who can answer your questions.

If you’re looking for a locally licensed, Thai-baht insurance plan, they’re a one-stop shop.

Brokers

You shouldn’t have trouble finding a broker in Thailand. The rate you get when going through a broker is the same as when you go to the insurance company directly.

The main advantage of a broker is that they can offer you a wider range of plans than an insurance company.

If you don’t already know which plan you want, they can give you details on what best suits your needs.

For example, if you want to get expat insurance, you can talk to our partnered broker who can give you advice and suggest different international plans that are suitable to your needs.

In theory, brokers are neutral and act in your best interest. In practice, in Thailand that’ll be true for good brokers and not so true for others.

One thing to keep in mind is that sales commissions for brokers are recurring.

For every year you stay with them, they get between 10% and 15% of your premium.

If you go through an insurance company, they keep that sales commission.

This means brokers have an incentive to sell you an insurance plan and keep you as a client in the future.

This recurring commission payment means that the broker will have a financial interest to help you out when it comes to dealing with insurance.

But brokers only offer you limited help with claims or disputes.

Aside from the details of the claim and your individual case, it depends on their relationship with each insurer and of course on the insurance itself.

Whether or not your broker sends your insurance company a lot of business, and whether or not your insurance company cares can make a difference.

In case you’re not happy with the support of your broker, you should also know that you can change brokers without changing insurance plans.

In short, signing up for insurance through a broker means you have one more person you can talk to before signing, and one more person to complain to after signing.

On the other hand, a broker might not know every single detail about every insurance plan for sale.

This is why it’s important to only buy health insurance from a broker that really knows stuff.

You can read our in-depth guide to insurance brokers in Thailand for more information about this topic.

Frequently Asked Questions

Below is a list of questions regarding health insurance frequently asked by expats living in Thailand.

Can I buy health insurance in Thailand?

You can get health insurance either inside or outside Thailand.

The only type of insurance that you need to obtain in Thailand is one that’s tied to the Social Security program, which is usually arranged for you by your employer.

Does Thailand have free healthcare?

Yes, and it is provided under the Universal Coverage for Emergency Patients (UCEP) program. However, it only applies to emergency treatments, usually for life-threatening medical cases.

And it’s available to Thai nationals only.

According to the UCEP Coordination Center, you can get free healthcare for the first 72 hours of treatment in any hospital nearest to you as long as your medical case includes the following symptoms or conditions: temporary unconsciousness, severe breathing problems, sudden chest pain, sudden limb weakness, and other symptoms that affect the circulatory (blood circulation) and nervous systems.

Please note that the free emergency treatment needs to be approved by the UCEP Coordination Center and you get free healthcare only for the first 72 hours of treatment.

The remaining cost needs to be paid out of the pocket or an insurance provider.

Do I need health insurance to enter Thailand?

You no longer need health insurance to enter Thailand anymore. However, it’s still a good idea to have some kind of insurance. It can be travel insurance.

Is there any recommended child health insurance?

An optimal way to go about getting health insurance for your child is to purchase family health insurance.

It’s basically group insurance that comes with a 10%-20% discount when you buy a plan with at least three family members under the same plan.

You can read our guide to family insurance in Thailand to get more information.

Is it possible to get health insurance in Thailand after 70?

If you are over 70 years old, it’s still possible to get health insurance in Thailand. Because of the new insurance requirements for the retiree visa, many local insurance companies have been introducing new plans especially for those who are over 70 years old.

For example, Luma has their Long Stay Care plan for anyone who is younger than 79 years old. Although it might not be as comprehensive as the expat plan, it’s much cheaper.

And you can use it to apply for the Thailand retiree visa.

Insurance Guide in Other Countries

We also have our health insurance guide in other countries including:

- How to Pick the Best Travel Insurance for Canada

- Health Insurance for Expats in China: What You Need to Know

- Health Insurance in Germany: What You Need to Know as an Expat

- Health Insurance in Malaysia for Expats: What You Need to Know

- Health Insurance in Vietnam: What You Need to Know as an Expat

- Health Insurance in Malaysia for Expats: What You Need to Know

Now, on to You

Are you left with questions about buying insurance in Thailand? Feel free to send me an email and I’ll help you out as best as I could.

Keep in mind I’m not a broker, lawyer, doctor, or professional proofreader, but when I wrote this article I did my best to research and fact-check.

I also can’t promise the info in this post is 100% true. Things always change with insurance. And although I do my best to keep this post up-to-date, you should check with a professional before buying insurance.

Thank you Karsen for your interesting article.

I am 82 yrs old, in perfect health and financially sound, and would like to live in Thailand on an retirement Visa.

I know that I need health insurance to comply with the application. Can I get one at my age?

Thanks,

William.

This is a great resource. Thank you for posting.

Bonus points for posting the year!

So many people forget to do that.

Excellent and very comprehensive article, thank you.

From my own experience as a foreigner living in Thailand with my Thai wife I would like to comment on local insurance companies. Luma and the likes are not really private local insurance companies, they are international insurance companies operating in Thailand. Local insurance companies are AIA, AXA, Allianz Ayudha, Muang Thai, etc. They offer health care to Thais and also foreigners, and they are IMO the much better choice if you can deal with the sometimes challenging language issues, and if Thailand is your home and you’re here to stay. It’s the same like in Germany, when living there an international insurance company based in the US or UK would not be preferable over a local German insurance company. I now pay substantially lower premiums for an even better coverage with my local insurer compared to the previous international insurer, but it is Thailand only and covers emergencies only during travels.

Hi, Thank you very much for writing a very informative article. It has awakened me to the many traps in this insurance quagmire.

I was wondering about your recommendation for Cigna as the preferred expat health insurance choice given that they dont guarantee lifetime renewal. Whereas Aetna does guarantee that. The other aspects of both companies’ basic plans are same/ similar whilst Aetna is actually significantly cheaper. IMO absence of renewal guarantee is a sure deal breaker. Am I missing anything?

Any guidance would be much appreciated.

Cheers

So, here’s the question: I am a ‘marriage visa” holder and I am already covered on the Thai social Security medical insurance, do I need additional proof of insurance to re-enter Thailand should I leave?

Does proof of being on the Thai government medical insurance plan fulfill entry insurance requirements?

Thank you,

Steve

As of now, it’s highly possible that you still need the proof of insurance. But this may change in the future. To get a precise answer, it’s best to contact an embassy of your home country since they are the one that give you the certificate of entry to Thailand.

Thanks Karsten Aichholz. This article is so informative. I gain a lot of Knowledge from. here. I have some question but everything is clear to me now.

Regards

Danke Karsten, very useful!

Karsten, Et Al;

Much Ado About Nothing.

For a clarification of what appears to be a (deliberate?) misrepresentation / misunderstanding with regard to a “mandatory health insurance requirement” for a “retirement visa”, please see the following web site: https://forum.thaivisa.com/topic/1115587-health-check-phuket-immigration-confirms-mandatory-health-insurance-for-o-a-%E2%80%98retirement%E2%80%99-visas-not-in-force/#comments

Regards.

R. Gibbs

Thanks for the input. I’ve edited the article to clarify that this doesn’t seem to be uniformly enforced. This said, it’s important to keep in mind that ‘hospitals having to admit everyone to the emergency room regardless of insurance status’ is also not uniformly enforced.

Getting health insurance before you need to make use of it is a good idea. That’s also the only time you can actually get it. I can’t count the number of e-mails I receive that start with ‘I always used to be healthy…’ before going into the details of a recent health issue that essentially made the person uninsurable.

Hi thanks for the detailed information Karsten.

I have a kidney transplant and have always been hesitant to travel, or live in another country because of it. I feel if I did decide to stay in another country for an extended period of time figuring out how to manage my whole medical dilemma I have would be tricky.

I’m 42 years old really but very healthy minus my transplant and I feel like I don’t have much time left. I don’t want to die having never left Phoenix, AZ. I feel trapped because right now I’m on accchs insurance which is exclusive to AZ.

In 2009 I was Infected with West Nile virus which led to severe encephalitis. I probably should have died but here I am.

I’m going to re-read your article now and try to figure out my best options. In your experience what would you say my best options are based on my position?

Again thanks for the great details.

Sounds like you have a bitter sweet history with health – both in terms of things you had to suffer through and situations you were lucky to survive. I’m not sure how things work in the US, but coming from Germany I know that there sometimes are health coverage options by your home / national insurance for temporary travel abroad. For temporary travel you might also be able to arrange for travel insurance, depeneding on what their individual exclusions are (see also here: https://expatden.com/thailand/thailand-travel-insurance/)

Just want to say thank you for doing this work.

This was very kind of you, and useful.

Thanks for saving me lots of time in my research here. Much appreciated!

So I checked with several companies for a short visit, with one month coverage. All of the companies I looked at are pre=pay and then submit for reimbursement, which would be the same as my Blue Cross, Except in the instance where you are admitted and then contact the insurance company they will do a guaranteed payment. Is there nothing like presenting your insurance card if you get sick or injured and do not require admittance?

Not for short term visits as far as I know. There would probably be way too many issues with fraud to make it worthwhile dealing with from an insurance point of view.

Hi Karsten,

I was wondering why you decided to go with an International plan? I understand that Thailand has a highly regulated market, providing consumer protecting, which I believe you do not have with ACS. Can you please comment on this point, as I have also narrowed down to ACS, but reluctant only because of this point.

Good question. When I looked at the plan for myself, I figured that an international insurance plan regulated by a European insurance agency was on par with a Thai plan regulated by a Thai agency: It might be harder to escalate a claim, but I figure the language barrier, available documentation and outcome of potential disputes would be more transparent and predictable.

Since then I talked to a number of people in the industry. From what I gather, the insurance companies and brokers have a great deal of respect for the OIC in Thailand (which is good). However, this also seems to be the case for international insurance companies. I assume the OIC can create a lot of problems for them as well, even if it’s not formally their jurisdiction – they still have to carry out some activities here (e.g. reimbursements, hospital cooperations, claims processing). So it seems in that regard it’s not much of a drawback to go with an international plan.

Another concern I had was that maybe an international plan would be less restricted in hiking their premiums. And indeed, the OIC limits the premium increases of local insurance companies from what I understand. However, that limit is something like 50% every three years … I’m sorry, but limiting premium increases to 50% every three years isn’t exactly a limit. So this doesn’t seem to add much.

All said and done, the issue is fairly technical and the practical impact is hard to judge. It’s a fairly new market with a limited number of disputes and it’s hard to tell what in the end is the best solution. While I also see benefits in having a local plan, I’ve personally opted for an international one, figuring the potential downsides to not be of much relevance in my case.

Hi Karsten,

I retired last year and still have health insurance from the Blue Cross. Is it accepted in Thailand or will I still need to buy local insurance?

I’d recommend checking with Blue Cross or your broker directly to see if your plan offers coverage in Thailand.

Hi Karsten,

Very useful info. Thanks for sharing.

I read discussions at the Thaivisa forum that most of the local insurance policies give the companies the right to raise premium at ridiculous rates at renewal when they found out that you have a long term illness, like cancer. Would you know if this is true? Thanks.

I’ve seen people warn against that possibility (and point out that the plans they advocate don’t do it), but all policies I looked at when signing mine had a disclaimer that prices would not be raised on an individual basis. However, I do hear about friends who have their premiums increase (and then decrease when they renegotiate), which certainly sounds like that could be the case.

I recommend checking the fine print and ask your broker about it. Feel free to get in touch in case you’d like me to share the contact details of one.

Of course if you already have it at signing and didn’t mention it, they’ll probably just cancel your coverage entirely and potentially ask back for payments already made on your behalf.

Thanks for your reply. It would be great if you can share the contact of your broker with me. Thanks again.

Well, we are not in the same leage. We don’t even have to compare insurances. You are paying 77 000 bath/year. I am 63 years old and I pay 17 000 bath/year…!

Obviously there are different price ranges depending on the coverage required.

Can you share more details about your insurance (e.g. company, plan, limitations)? Would make it helpful for other people reading this.

Hi there Karsten!

You’re terrific for being so kind to put this all together for us – thank you heaps for your wonderful efforts. My question is rather open and I fully realize it truly depends on the individual’s preference, current health, and budget. But overall in general Karsten, what would be a comfortable amount to have as a maximum coverage to feel secure?

I see max coverages amount to 500,000 and 750,000 and of course anything over 1mill baht. I’m very healthy and rarely need a doctor, but I’m worried about some unforeseen accident/surgery that could result in numerous days in the hospital.

Anyway, I’d love to hear what ‘you’ yourself would think is a comfortable max coverage to have, where it doesn’t break the bank. Thanks so much indeed Pal, I’m very grateful!

I’m comfortable with USD 500,000. It means that short of an extraordinary catastrophic coincidence, treatment at any and all facilities in the country (including the ICU at Bumrungrad) would be covered.

The government social security service tends to consider it possible that patients can accumulate THB 2m per treatment at a government hospital and recently raised their internal billing limit to that amount. I’d thus consider that a minimum if you were to get private insurance.

I understand your frustrations, though changing at this point would come at a very, very steep price (if it’s possible at all). I’d strongly advise trying to see if you can resolve this without changing providers.

Hi Karsten, please forgive me should I be hassling you with my concerns. But I really do not know what to do and your advice is so greatly appreciated!

I’m sorry to ask for clarification of your recent comments…

For what reason are you advising that insuring myself with another company would be much more expensive than what I currently pay? Is it just a case of starting with another company at my age? OR because there is a chance that BUPA will decide that they’ll ignore what happened 30 odd years ago and reverse the decision, thus covering my hospital costs of a couple months ago and allowing me to continue being fully covered without extra charge? (Even if they did the later, I am sure that any future incident would not be considered as a one-off incident but as a preexisting condition that they will not cover.). OR is it something that I haven’t even realized?

Let’s face it, because the doctor wrote to the insurance company and used the word “seizure”, if it were to happen again, even if it be caused by a completely different reason, the word “seizure” would be enough for them to say “No”, don’t you think?

Again, I really appreciate your suggestion because even when I asked a Professional, (the broker), I got nowhere and now I don’t know where to turn. (Plus it is soooo busy each day at work that I cannot afford to take a 10minute break all day let alone shop around all the insurance companies out there!).

Thanks again!

If you were to switch now, all pre-existing conditions are definitely excluded at your next insurer (pretty much everything that you field a claim for and has any likelihood of recurring). So your coverage would definitely get worse.

Challenging on BUPA is not about asking them kindly to change their mind on a courtesy basis. It would be to look at the fine print and your originally provided information to see if something that happened more than 10 years before you signed up would indeed be classified as ‘pre-existing’ condition. It’s hard to say without seeing the actual contract. However, if this wasn’t specified as an exclusion and you didn’t provide false details when you applied, there is a chance you can legally challenge them on this. I recommend consulting the Office of Insurance commission or talking to a lawyer to see if that’s possible. If the regulatory body or a court orders them to pay, it could be a ruling along the lines ‘this is not a pre-existing condition’ and all subsequent treatments may be covered as well.

I’m not an insurance specialist or lawyer, so take this with a grain of salt. My recommendation is to talk to a lawyer or independent insurance body to get advice on this case before you cancel or switch your current coverage.

Thank you very much. I won’t trouble you again with my case and do greatly appreciate your time and advice.

Thanks very much, Karsten! A good read! Unfortunately, it didn’t really tell me what I am online looking for.

I’ve had top hospital coverage with Blue Cross/BUPA since moving to Thailand 17years ago (although not OPD which, as you said, is not worth it!). I’ve had three stints in the very comfortable BNH Hospital during that time which insurance saw were nearly fully covered and have always enjoyed the peace-of-mind that insurance provides. However, recently I had a seizure (which unfortunately I told BUPA I had one of 30 years ago!). One night in ICU cost me 90,000-baht and BUPA refused to pay one baht of it! I am trying, with little success, to find health insurance which will cover a preexisting condition. BUPA won’t allow me to pay an additional premium on top of the already sizeable amount I’m paying to cover a preexisting condition. I’m stressed as I feel uninsured. Stress leads to seizures, they say. So that’s more stress. The broker I saw was useless, (he was only interested in what the company I work for pays each year because that’d be big commission!!). I guess I need to be pointed toward an insurance company that will provide a 50 year old with health cover and allow me to pay an additional amount for a preexisting condition. Any advice would be extremely appreciated!

Sorry to hear about the seizures and the insurance issue with it.

You can actually change your broker if you feel unhappy with their service (without having to change insurance companies). Shopping around for a more supportive provider can be helpful and your commission (which is recurring – so every year you stay with that broker, they keep getting it) can go to a more helpful one.

Are you sure the insurance was right to deny the claim? I’d double-check that – it’s possible that if the last incidence was several years before you signed up, this may not count as a pre-existing condition (depends on the wording of the insurance and their sign-up questionnaire). You can consider challenging them on that claim, either by going to the office of insurance commission (ask a Thai friend to help) or to a lawyer who specializes in it. While the disputed amount might not make that worth it, ongoing coverage might very well do.

Finding a provider with a serious pre-existing condition is probably not possible.

Since you went to BNH though, you can consider going to Chulalongkorn Hospital next time (which is nearby). Their treatment quality is pretty good and it’s a lot more affordable. While not as good as full insurance coverage, it does provide an option to secure affordable medical care.

Thanks Karsten,

This was really useful when I was compiling quotes! Any comments on cover for preventive screening tests such as colonoscopies, mammograms, prostate tests etc?

Best Regards

Michael

Some insurance companies specifically preventive screening, others have a budget for health checkups (e.g. my plan at ACS allows USD 300 of health checkups every 3 years). I don’t have the details for other companies off the top of my head, but in general that’s something you’ll find in a number of plans.

Thanks Karsten.

I was already recommended ACS by a friend. I have been researching for a few weeks. I have even met with some agents (locally).

I have decided on ACS as well due to:

1. The friend who recommended – had a friend who had no issues in claiming a motorcycle accident that he had in Chiang Mai. It was quite a large sum.

2. Cost and benefits that ACS provides.

3. Your recommendation

Let us know if anything should change in your opinion or if you find something that is better.

Thanks for the recommendation and yes i follow your blog (although, i have not read everything and this is my first post to you)

Michael

There’s a British doctor called Dr Donna who provides an incredible kind of General practice/ family medicine services. Her clinic is based in sukumvit soi 49 and is called Medconsult. Would thoroughly recommend as Dr Donna has been the main doctor in Bangkok for myself and my family since we moved here and Dr Donna is just a world-class, very skilled doctor.

Another plus is that I don’t pay as they bill it all straight to my insurance which is hassle-free and great for us!

Not taking out insurance is a fool’s errand. Not only is it not true anymore that treatment is cheap, but some hospitals charge way more than what you might be used to paying at home (and this is comparing the actual cost of treatment in your country not taking into account whether your home country social security such as Medicare or private health insurance takes care of it or not) and some hospitals are even known to charge foreigners extra compared to locals.

Just because some insurance broker claims foreigners’ choice of hospitals and lifestyles increase their premiums, doesn’t make that an excuse not to take out a policy. Unless you’re an out of work foreigner or one who works a low end English teaching job without a proper work visa, you have no excuse not to take out some sort of health insurance policy – the best ones being as you mentioned in your first few paragraphs travel insurance policies taken out before you leave. If you work for a Thai based employer, more than likely they’ll sign you up to some sort of Thai or expat insurance policy.

Very useful information for long term stays abroad.

As you, I started out using travel insurance from Germany, which seems to be a very good choice for the first 5 years. I actually just did a comparison of 50+ available options to Germans, Austrians and Swiss Travelers:

http://www.flocutus.de/auslandskrankenversicherung/

After 5 years you have to look for Expatriate insurance like the ones you mentioned.

Hi Karsten,

Thank you for your article on health insurance! Since I will be moving to Thailand next month your insight is extremely relevant and useful. Cheers!