The PND 50, also referred to by some as the Corporate Income Tax (CIT) 50, is a tax return form that needs to be filed annually by companies and juristic partnerships in Thailand.

Read on to find out more about annual corporate income tax returns and how you can submit the PND 50 for your company in Thailand.

"*" indicates required fields

Disclaimer: This article may include links to products or services offered by ExpatDen’s partners, which give us commissions when you click on them. Although this may influence how they appear in the text, we only recommend solutions that we would use in your situation. Read more in our Advertising Disclosure.

Contents

We have exclusive business content with insider business tricks that you can’t find anywhere else.

By becoming a subscriber of our Business tier, you can get immediate access to this content:

- Karsten’s List of Personal and Professional Services

- A Step-by-Step Guide to Registering a Company in Thailand on Your Own

- Taxes You Have to Deal with as a Business Owner in Thailand

- Employee Regulations You Must Know as a Business Owner

- Increase Your Chances of Getting Tax Refunds for Your Company

That’s not all. You get a free consultation with a corporate lawyer, a free consultation with an accountant, enjoy ExpatDen ad-free, and get access to over a hundred pieces of exclusive content to make your life in Thailand hassle-free.

Here is the full list of our exclusive content.

To get access to these exclusive business guides and more, become a subscriber.

What Is It?

The PND 50 is an Annual Income Tax Return for Companies or Juristic Partnerships. You need to file it every year to the Revenue Department if you have a registered company, regardless of the size of the business.

Corporate income tax must be paid twice per accounting period using the Half-Year Income Tax Filing Form (PND 51) and Annual Corporate Income Tax Filing Form (PND 50).

Who Needs to File It?

Corporate Income Tax (CIT) is a direct tax levied on registered companies in Thailand, which includes legal entities or partnerships operating in Thailand or operating elsewhere but earning certain types of income in Thailand.

Related: General: A Step-by-Step Guide to Registering a Company in Thailand on Your Own

The following types of companies are liable to file the PND 50:

- Any company, juristic partnership, or joint venture incorporated under Thai law

- Foundations or associations carrying on revenue generating business in Thailand (there are some exemptions for charities and foundations under Section 47 (7) (b) of the Revenue Code)

- Companies or juristic partnerships incorporated under foreign laws and carrying on business in Thailand or other places including Thailand, including cases where an employee, an agent or a go-between carries on your business and generates income or profits in Thailand

There are special exemptions on corporate income tax for BOI companies.

BOI companies must prepare the Por 1-2549 Application form for Exercising Corporate Income Tax Exemption Rights and Benefits for the Accounting Year, which must be audited by an external auditor before delivery to the Revenue Department and BOI.

A local accountant can help you with the auditing process.

Learn More: How to Set Up a 100% Foreign-Owned BOI Company in Thailand

How to Prepare PND 50

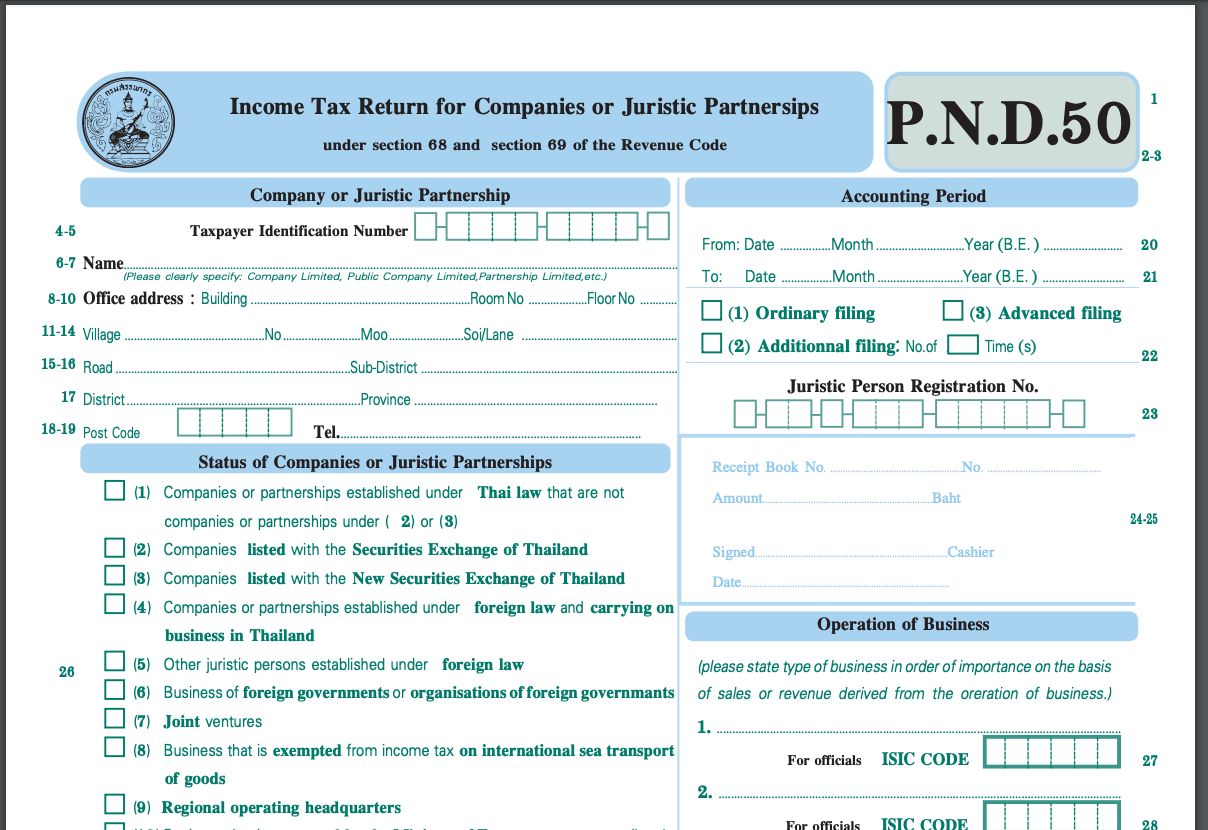

You can get an English copy of the PND 50 form from the Revenue Department website.

Within the form, you need to list out information from your financial statements, including the company’s net profit which is the sum of total revenues minus total deductible expenses.

You will also need to list out non-deductible expenses, including but not limited to personal expenses and gifts or expenses that lack sufficient supporting documents (for example, missing invoices or receipts).

Corporate Income Tax Rate

Corporate income is taxed at 20% of the company’s net profit.

However, if the company is categorized as a Small and Medium-sized Enterprise (SME) with paid-up capital not exceeding 5 million Thai baht and/or revenues not exceeding 30 million Thai baht for the fiscal year, the tax rates are as follows:

- Net profit ≤ THB 300,000 – Taxed at 0%

- Net profit of THB 300,000 – 3,000,000 – Taxed at 15%

- Net profit ≥ THB 3,000,000 – Taxed at 20%

At the end of the form, you need to fill out the total amount of tax you need to pay or return.

Supporting Documents for PND 50

To prepare the PND 50, you need to send all of the following to your accountant:

- Form PND51 submitted in the same year

- Financial statements (Profit and loss statement, Statement of financial position, Statement of changes in equity, and Notes to financial statements)

After that, the accountant will fill out the PND 50 and send it to the Revenue Department.

How to File PND 50

There are two ways you can file the PND 50. You can file it on paper at your local Revenue Department. Or you can e-file it through the E-Filing website.

You just need to choose the PND 50 form and file it digitally.

After that, you can save the file to your company for a record. It is suggested to save your company tax documentation for a minimum of five years.

If your company does not yet have a username and password for e-filing, you can use this website to fill out the Por. Or. 01 request for e-filing.

If you use an accountant to open your company and register for VAT, they may have already created an account for you.

E-filing is much more convenient, and most companies have shifted to e-filing already.

In addition, you can also file other types of corporate tax through this website as well, such as the half year tax return (PND 51).

Learn More:

Accounting Firms in Thailand

Banchee Legal House

A law firm in Bangkok with a broad range of legal and business services to offer their clients.

Contact Banchee Legal HouseCan I File it Myself?

Although it’s possible to do it yourself, it’s better to hire an accountant to prepare and file the PND 50 form for your company, as the format to document expenses on the form is very complex, to prevent any penalty for filing incorrect information.

The accountant can also help you talk with a Revenue Department officer when they have any questions with the form – which is really helpful unless you can speak Thai fluently.

Learn More: The Complete Guide to Learning Thai Online And Available Courses

How to Pay Tax

After you file the PND 50 form, you can pay tax directly to a local Revenue Department or make a bank transfer.

How to a Get Tax Return

To get a tax return, there are three options: it can be in cash (if you file it at a local Revenue Department), via bank transfer, or get a tax credit for tax filing next month.

Learn More:

Increase Your Chances of Getting Tax Refunds

When to File Your Annual Income Tax Return

The following deadlines for corporate income tax filing apply to companies incorporated under Thai law:

- PND 50: Within 150 days from the last day of an accounting period or within the month of May

- PND 51: Within 2 months from the last day of the 6-month accounting period or within the month of August (excepting the company’s first accounting period which has a duration of less than twelve months).

Learn More:

When and How to File Taxes as a Business Owner in Thailand

Late Fines

It is important to complete the Annual Income Tax Return on time to avoid penalties, and accurately to prevent having to file amended returns.

There are severe penalties for not filing company taxes according to schedule as follows:

- Criminal fines of up to 2,000 baht for filing overdue forms:

- 1,000 baht for a delay of seven days or less after 150 days from the end of the accounting period

- 2,000 for a delay of more than seven days after 150 days from the end of the accounting period

- A criminal fine of 2,000 baht for not submitting financial statements

- An interest rate of 1.5% per month (a fraction of a month is counted as 1 month) on overdue corporate income tax

Learn More: Taxation in Thailand: 6 Common Mistakes

What if I Need to Close the Company?

In the event that you close down your company, you need to file the following forms to notify the Revenue Department to cancel the company inside their system otherwise they will continue to send you reminders for filing corporate income tax:

- Lor. Por 10.3

- Liquidator’s ID card or passport

- Company affidavit with closed status

Learn More: Get the Right Company for Accounting Service in Bangkok, Thailand

Now, on to You

Handling company accounting in Thailand – filing annual tax returns and half-year tax returns – can be complex, especially if you don’t speak Thai. Become aware of the tax returns you are liable to file as a business owner, and don’t fall prey to common accounting mistakes.

Remember that with the help of local accounting firms who know the ins and outs of the Thai accounting system and are experienced in dealing with the Thai Revenue Department, you can stay in compliance with little to no headache even without a large accounting budget.