Travel insurance in Malaysia has grown leaps and bounds over the years. As such, travel insurance has most certainly been at the forefront when it comes to the development of the various products of insurance companies in Malaysia.

When people think of travel, they usually picture long stretches of sandy beaches or lying by the side of a beautiful blue swimming pool in complete and utter relaxation. The thought of getting on a plane is exciting and there are usually all kinds of fun and activities to look forward to.

The last thing that one thinks about when planning for a travel experience is all the things that could go wrong!

However, it cannot be denied that anything can happen at any time. As such, it is best to think about what could go wrong and plan for it accordingly.

That is where travel insurance comes in!

Up until the last couple of decades or so, travel insurance was seen as unnecessary and tedious. However, in recent years, there has been growing awareness of its importance.

As travelers become more conscious of the benefits of travel insurance, insurance companies have also become more competitive in marketing their travel insurance products.

This includes introducing various ways to make purchasing travel insurance easier for travelers. Plenty of travel insurance policies can be bought online, with little to no formalities or documentation required.

This definitely bodes well for frequent travelers, especially for backpackers, extreme sports enthusiasts, and adventure travelers.

In this article, we embark on an in-depth exploration of everything you need to know regarding travel insurance in Malaysia, both for travellers who are coming to Malaysia and Malaysia residents who want to travel abroad.

Disclaimer: This article may include links to products or services offered by ExpatDen’s partners, which give us commissions when you click on them. Although this may influence how they appear in the text, we only recommend solutions that we would use in your situation. Read more in our Advertising Disclosure.

Contents

- What is Travel Insurance?

- Why is Travel Insurance Important?

- Is Travel Insurance Necessary?

- Travel Insurance in Malaysia in a Nutshell

- How Does Travel Insurance Work?

- Types of Travel Insurance Coverage

- General Facts About Travel Insurance in Malaysia

- Best Travel Insurance in Malaysia

- An Alternative Way to Purchase Travel Insurance: Airline Travel Insurance

- What to Look Out for When Buying Travel Insurance

- General Exclusions for Travel Insurance Policies

- Travel Insurance for Hajj and Umrah Pilgrimages

- What is the Best Travel Insurance in Malaysia?

- How Much is Travel Insurance in Malaysia?

- Can I Still Buy Travel Insurance After Booking?

- Now, on to You

What is Travel Insurance?

Travel insurance is essentially a plan that you purchase to compensate you for any unforeseeable or unfortunate events that may occur during your travels.

Broadly speaking, these unforeseeable events may include:

- Illnesses or injuries sustained during travel

- Loss of personal effects

- Canceled or delayed flights

Of course, this list is not exhaustive. At the end of the day, what exactly you will be compensated for will depend very much on the type of plan that you purchase from your insurance provider.

Why is Travel Insurance Important?

How many times have we closed a pop-up window asking us if we want to purchase travel insurance while booking our flight tickets?

Understandably, when you are planning for your travels, you don’t want to consider all the unfortunate events that could occur on your journey.

However, this is one of those situations where it is better to be safe than sorry.

Travel insurance is important so that in the event of any emergency, you know for a fact that you will not need to worry about the financial aspect of it.

You can rest assured knowing that your expenses are covered and you don’t have to fork out a substantial sum of your funds to ensure that those emergency expenses are taken care of.

Is Travel Insurance Necessary?

Upon reading details of how travel insurance in Malaysia operates and the fine lines and distinctions that come into play about what can and cannot be covered, you may be wondering if it is absolutely necessary to purchase travel insurance.

The question may ring even louder for you if you already have existing life insurance, medical insurance, personal accident insurance, or even insurance from your credit card.

This will all depend on whether your existing insurance policies cover events that may occur while you are traveling.

Usually they do not, which is where travel insurance becomes absolutely vital, especially if you regularly engage in adventure sports or extreme activities, or if you tend to travel frequently to remote places around the world.

Your existing policies may also expressly exclude coverage if you suffer from any loss, damage, or injury while you are traveling.

That being said, if your existing policies do indeed cover you for any accident, death, or permanent or temporary disability, your travel insurance can work as additional compensation for you in the event you suffer from any of these events.

As such, it is probably best to play it safe and purchase travel insurance before you embark on your journey.

Travel Insurance in Malaysia in a Nutshell

When it comes to travel insurance in Malaysia, insurance providers and companies are all about customizing plans to suit your needs.

There are plenty of companies and providers to choose from, so you can shop around to ensure you get the best value for your money.

And there are also many kinds of plans and coverage types, to ensure that your travel insurance needs are met accordingly.

Most importantly, you can find travel insurance in Malaysia no matter what your budget is.

Whether you are planning to travel locally or overseas, whether it is for a short trip or for a year-long trip around the world, you can rest assured knowing that you have some of the best travel insurance to cover any risks that may materialize during your journey.

At the end of the day, the most important thing when it comes to purchasing travel insurance in Malaysia is to ensure that you read the policy documents in detail and understand them properly, so that you know what your rights and obligations are at all times.

How Does Travel Insurance Work?

When you purchase travel insurance, you are in essence paying to be compensated for something that may or may not happen.

As such, you are protecting yourself against the risk of some loss or injury that may occur during your travels.

If the risk materializes, your insurance company will compensate for the value of the loss or injury that you have suffered. This is often referred to as a claim.

For you to be able to successfully make a claim against your travel insurance policy, you need to provide evidence or proof that the risk actually materialized.

For example, if your travel insurance policy provides insurance coverage for flight delays, then you must be able to show that the flight was actually delayed. This can be by way of a letter from the airline.

If your insurance policy provides coverage for emergency health coverage, you should be able to show that it’s not a health condition that you are aware of before your trip.

The insurance company must be convinced that the unforeseeable event actually occurred before agreeing to pay your insurance claim.

If the risk does not materialize, then there will be no compensation or money owing to you.

At this juncture, it is important to remember that you will only be compensated for the event that you have purchased travel insurance coverage for.

If the loss or injury falls outside the coverage that you have paid for, then it is unlikely that you will be compensated.

For example:

Ben purchases travel insurance for his trip from the United Kingdom to Malaysia. The plan that he has chosen has coverage for canceled flights and lost baggage.

Scenario 1

Ben’s travels are smooth and no unforeseeable events materialize.

The insurance company does not need to compensate him.

At the same time, Ben cannot ask for a refund of the money that he paid for the purchase of the travel insurance. The insurance company will not refund him the amount that he paid to purchase the travel insurance policy.

This is because it was bought to protect him against the chance of an unforeseeable event occurring.

Scenario 2

Ben’s flight from Malaysia is suddenly canceled and he now has to stay in a hotel before he can fly home.

Ben can then put in a claim to his insurance company for the canceled flight and the extra expenses he had to incur as a direct result of the canceled flight. This will need to be accompanied by proof of the same.

Once the claim is approved, the insurance company will compensate him for the amount for which he is covered under the plan for these circumstances.

Scenario 3

Ben loses his passport while he is in Malaysia.

Ben is unlikely to be able to claim for the loss of his passport or any expenses that he may incur as a direct result of the lost passport.

This is because the travel insurance coverage that he has purchased only reimburses him for canceled flights and lost baggage.

Types of Travel Insurance Coverage

From the various practical illustrations above, it can be seen that it is important to know exactly what your travel insurance plan covers. This is to ensure that your exact coverage needs are set out in your travel insurance policy contract.

While it may depend on which travel insurance company or travel insurance provider you choose to go with, there are some common types of travel insurance coverage.

These include but are not limited to:

- Medical coverage

- Emergency medical coverage

- Lost personal items

- Stolen personal items

- Baggage delay

- Accidental death

- Damage to baggage or personal effect while in transit

- Worldwide coverage

- Adventure travel coverage

- Extreme sports coverage

- Personal injury coverage

- Flight accident coverage

It is important to note that the specific circumstances of the coverage and all the relevant details should be expressly set out in your travel insurance policy contract.

This is to ensure that there are no misunderstandings between you and your travel insurance company if you need to make a claim.

General Facts About Travel Insurance in Malaysia

When you are looking to purchase travel insurance in Malaysia, it is good to be familiar with some of the basic aspects of travel insurance.

This will help you to identify exactly what you need when you are on the search for the best travel insurance plan for you and/or your family.

Generally, most travel insurance companies in Malaysia have the following options:

Single Journey or Annual Plans

You can choose to buy travel insurance for a particular trip that you are making. This means that any travel insurance coverage will only be for that trip. This is usually referred to as single journey travel insurance.

Alternatively, if you are a frequent traveler who usually spends a long time at a particular destination, then it may be more worthwhile for you to get on an annual travel insurance plan.

This means that you would pay either a monthly or annual premium to maintain that travel insurance coverage.

This is beneficial for those who travel frequently because they can have peace of mind knowing that they are covered for any unforeseen circumstances that may occur during their travels and/or while they are transiting between countries.

It also means that they do not have to think about having to purchase separate travel insurance for each and every journey that they embark upon.

Individual or Group Plans

When you are purchasing travel insurance in Malaysia, many insurance providers also have the option of choosing if you want to buy a plan just for yourself or if you want to buy a group travel insurance plan.

The latter is popular with those who are traveling with their family or a group of friends.

This essentially means that everyone in the identified group is covered under the same plan.

Group travel insurance in Malaysia is rather popular because the premium rates are relatively lower.

For the most part, they are purchased by families traveling together or even companies who take their staff on annual trips.

Shariah Compliant Travel Insurance

Malaysia, being a Muslim-majority country, has incorporated shariah-compliant products into their various financial services, and travel insurance is no exception.

Shariah compliance basically means that those products are in line with the principles of Islam. While this has a wide definition, when a product is branded as shariah-compliant, it generally means that it is a socially responsible product.

Many local travel insurance providers in Malaysia have a Shariah-compliant travel insurance option for those who require it.

Best Travel Insurance in Malaysia

When we talk about travel insurance in Malaysia, we can separate it into two groups.

The first group is for tourists who are planning to travel to Malaysia while the second group is for those who are currently living in Malaysia such as Malaysia residents and Malaysia citizens who want to travel abroad.

In general, the first group needs to take a look into international travel insurance companies while the second group should look at travel insurance providers in Malaysia.

International Travel Insurance

International travel insurance is for anyone who’s planning to visit any countries in the world, including Malaysia.

What’s great about international travel insurance is that they may not only cover you in Malaysia, but also other countries as well.

For example, you can use World Nomads when you travel to both Malaysia and Thailand.

Unlike local travel insurance, international travel insurance is available to almost every nationality in the world.

It is important to note that most travel insurance providers require you to purchase your travel insurance at least a day before you commence your journey to your destination.

As such, if you are looking to travel into Malaysia, there are some great international travel insurance providers that allow you to quickly and easily purchase your travel insurance online.

These international travel insurance providers are:

World Nomads

World Nomads is probably one of the best-known international travel insurance providers. They take pride in the fact that their travel insurance plans are designed by travelers for travelers.

More importantly, their travel insurance plans are flexible and easy to purchase. You only need to answer a few questions regarding your travel plans and you get an instant travel insurance quote.

Claim processes are also processed and handled completely online so if you have to make a claim, it is incredibly efficient to do so.

Although World Nomads can be more expensive than other providers, they have an extremely comprehensive range of coverage, which includes emergency evacuations and travel gear protection with a coverage limit of $500,000.

They also cover more than 200 different types of travel activities.

So if you want comprehensive travel insurance or plan to go bungee jumping in Selangor or white water rafting in Perak during your travels to Malaysia, then World Nomads is a great choice for travel insurance.

SafetyWing

If you are traveling to Malaysia as a digital nomad or intend to make Malaysia your base as a remote worker, then SafetyWing has got your back.

Specializing in nomad travel insurance for those who are away from their home country, SafetyWing provides international travel insurance coverage for those who are below 69 years old.

Their travel insurance coverage extends to all countries around the world except Cuba, Iran, and North Korea.

SafetyWing is a great option for those who are constantly on the go because they are one of the rare travel insurance providers that allow you to purchase your travel insurance once you have already reached your destination.

However, do note that this may mean a waiting period of about 8 days before coverage kicks in.

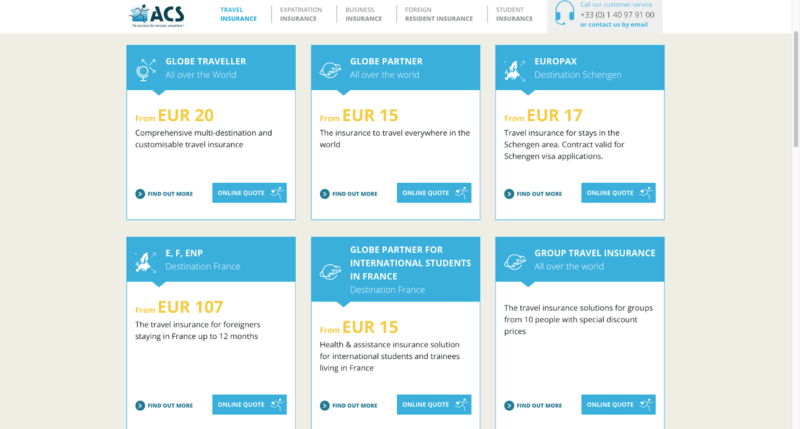

ACS Globe Traveller

ACS Globe Traveller is an all-inclusive international travel insurance provider.

They have a few different plans to choose from depending on your destination, length of stay, and budget. Upon purchasing any of their plans, you get immediate coverage for any hospitalization expenses you might incur.

With over 40 years of experience in the travel insurance industry, ACS Globe Traveller has perfected its claims and reimbursement procedures and the entire process is quick and easy.

If you are looking for a great value-for-money international travel insurance provider, then ACS Globe Traveller is the way to go.

Local Insurance Providers

If you are living in Malaysia and want to travel abroad, you should take a look at local insurance providers.

Please note that some of them may only be available for Malaysian citizens or residents.

Zurich Travel Insurance Malaysia

Zurich has probably one of the most popular travel insurance plans in Malaysia. Its coverage countries are divided into 3 areas as seen below.

From there, you can choose from their range of extremely comprehensive plans. Generally, depending on the type of plan you go for, coverage can include:

Unlimited Cover and Medical Related Covers

This covers medical expenses, including dental expenses and any follow-up treatments in Malaysia, alternative medicine treatments, and childcare benefits as well.

Travel Inconvenience Cover

This includes situations like travel cancellations, delays, or interruptions, as well as lost baggage, personal items, or passports.

Personal Accident and Liability cover

This covers, among other things, accidental death and permanent disablement.

Urban Traveler’s Cover

This includes pet care benefits, car rental excesses, and any emergency telephone and internet usage.

Tokio Marine Travel Insurance Malaysia

Tokio Marine has had a long-standing presence in Malaysia. Just like most travel insurance in Malaysia, Tokio Marine has a few different plans to choose from depending on your coverage needs.

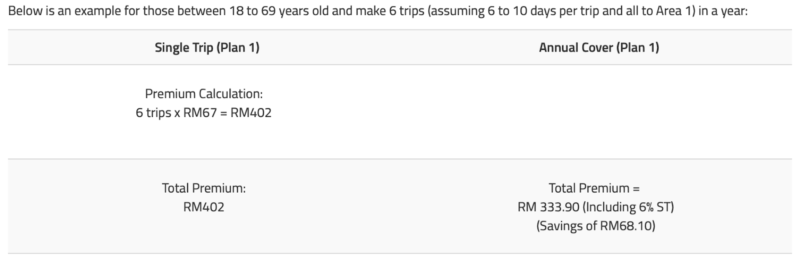

One of the things that stands out about Tokio Marine’s travel insurance plans is that they have the option of an annual plan. These are catered for those who go on multiple trips per year for long periods at a time.

The main advantage of this is that you don’t have to think about purchasing travel insurance for each trip.

You can start your trip knowing that you are properly covered in the event of any unforeseeable events. Additionally, extreme activities are also covered for an increased premium amount.

Tokio Marine’s travel insurance also has specialist coverage for domestic travel insurance in Malaysia, which is rather unique in the context of the Malaysian travel insurance landscape.

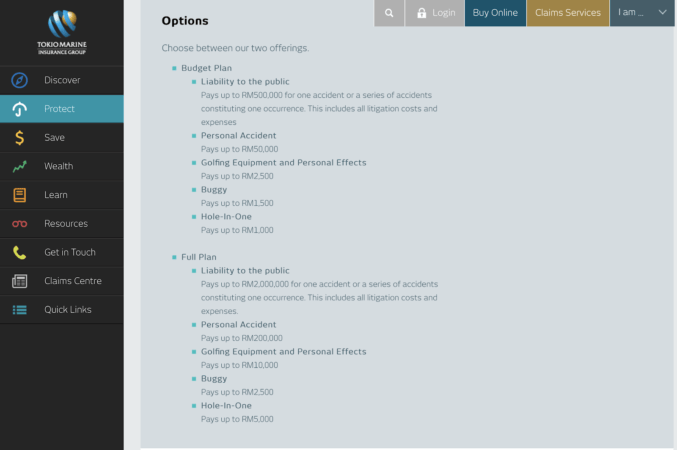

If you are a golfer, Tokio Marine has a special travel insurance plan just for you!

MSIG Travel Insurance Malaysia

While MSIG is a relatively new player in the insurance game in Malaysia, they are most certainly up and coming.

They have one of the most simplified travel insurance plans available in the country.

So if you like things straightforward with minimum complications, then MSIG travel insurance is for you.

MSIG’s travel insurance product is known as TravelRight Plus. You can choose from either the single trip plan or the annual plan.

For those who travel frequently, the annual plan certainly has more value for money. This can result in a significant amount of savings as far as your travel insurance needs are concerned.

AXA Travel Insurance Malaysia

AXA’s travel insurance gives you the option to purchase travel insurance based on whether you are traveling internationally or domestically.

Coverage and premium payments also depend on whether you are signing up for a single travel plan or an annual plan.

More importantly, AXA is the perfect travel insurance company to run to if you forget to purchase your travel insurance and have to do it at the last minute!

AXA allows you to buy travel insurance online in Malaysia at any time and provides you with instant coverage.

This means you are covered from the time that you make the necessary payment and submit all the required documentation.

So technically, you could purchase your travel insurance while you are rushing on your way to the airport!

AXA is also one of the few insurance companies in Malaysia that offer a relatively high coverage limit. They pay for any medical or hospital expenses for up to RM300,000 for any injury that you may sustain while you are overseas.

They also offer travel insurance coverage for unique activities such as leisure scuba diving and leisure winter sports.

More importantly, AXA’s travel insurance plan expressly covers any emergency medical evacuation that you may need during your travels.

Great Eastern Travel Insurance Malaysia

Great Eastern is one of the oldest life insurance companies in Malaysia. With decades of experience under its belt, Great Eastern is widely known for its efficiency, especially with regard to its claim processes.

As far as travel insurance is concerned, Great Eastern has 2 broad plans:

Travel For More

This plan covers medical evacuation and repatriation, as well as for the loss of travel documents and personal money.

More importantly, it also provides coverage for your home in the event of a fire while you are traveling outside of Malaysia.

This is certainly one of the more unique benefits offered by Great Eastern’s travel insurance plans.

Great Voyager

This plan from Great Eastern travel insurance covers more traditional travel issues such as travel inconveniences and baggage and flight delays.

It also provides substantial coverage for medical and hospitalization expenses as well as any accidental death or permanent disability that may occur during your travels.

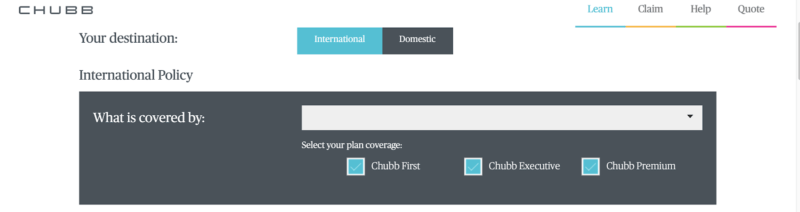

Chubb Travel Insurance Malaysia

Chubb travel insurance also allows you to start choosing your coverage plans based on international travel insurance or domestic travel insurance.

From there, they have three different plans to choose from.

They have the Chubb First, Chubb Executive, and Chub Premium plans, depending on your travel insurance needs and budget.

Some of the coverage benefits that Chubb’s international travel insurance Malaysia provides include:

- Accidental death and disablement

- Any follow up expenses in Malaysia that are related to the injury that you sustained while you were overseas

- Alternative or traditional treatments

- General travel inconveniences, including any fraudulent use of stolen or lost credit cards

- Hijacking

- Pet care

- Events of terrorism

As you can see, the coverage provided by Chubb travel insurance is rather comprehensive.

Additionally, they also provide a cruise option if your overseas travel involves a journey on the high seas! This is one of Chubb’s unique offerings as not many travel insurance companies in Malaysia provide this option.

Allianz Travel Insurance Malaysia

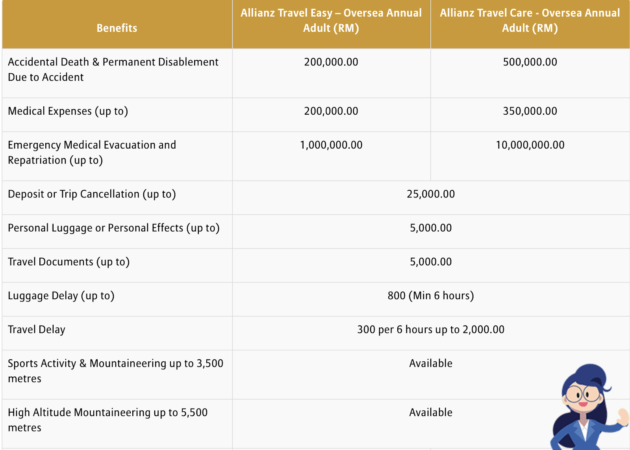

Allianz’s travel insurance plans are rather straightforward. They have the Allianz Travel Easy plan and the Allianz Travel Care plan, depending on your travel insurance needs and budget.

The travel plans appear to expressly cover any sports activity, mountaineering, and high altitude mountaineering as well. The amount of coverage for these activities however will depend on your overall risk profile and will need to be assessed separately.

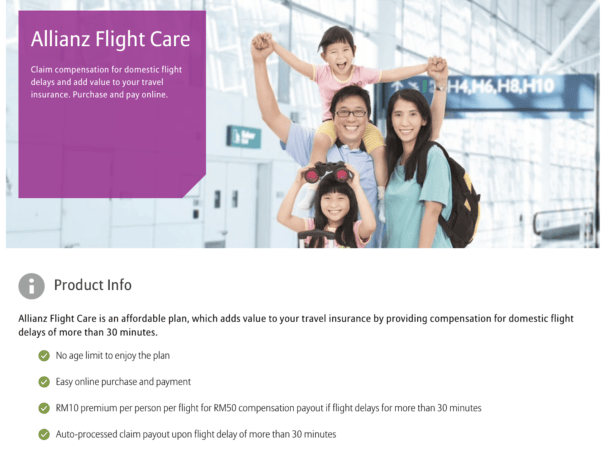

In addition to this, Allianz also has a specific plan for any flight or baggage issues that you may face during your travels. This is the Allianz Flight Care plan.

This is probably the easiest and most affordable plan to apply for. As a bonus, the claim process is a breeze. You can apply for the travel insurance plan online at any time before your journey.

That being said, it must be noted that this is applicable only for domestic flights i.e. any flights you might take internally within Malaysia.

Any claims that you make within the terms and conditions of the policy can be processed online as well, within 30 minutes.

Now that’s efficiency right there!

AIG Travel Insurance Malaysia

AIG has some pretty comprehensive domestic and travel insurance plans.

Depending on the plan that you choose, they can cover up to RM1 million in terms of any medical expenses that you might incur.

In addition to the more common coverage categories that are covered by most travel insurance plans, AIG’s travel insurance plan also covers any natural disasters that may occur during your travels.

If you regularly go golfing during your travels, AIG has a Golf Insurance Rider that you can add to the standard travel insurance plan.

This covers for loss or damage to your golf equipment or for any expenses that you may need to incur as a result of property damage or injury to another person.

It must be noted however that while this golf rider applies worldwide, the USA and Canada are expressly excluded.

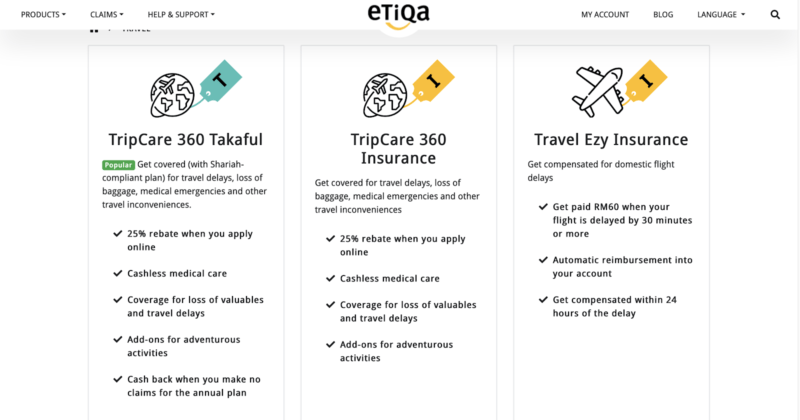

Etiqa Travel Insurance Malaysia

Etiqa claims to be one of the best online travel insurance companies in Malaysia.

They are indeed one of the more popular and widely marketed companies.

With the aim of being a leader in online travel insurance in Malaysia, Etiqa provides some substantial incentives to encourage people to buy their travel insurance online.

This is in the form of discounts on the total price of the plan of your choice.

Etiqa’s Travel Ezy Insurance plan also provides specific coverage for domestic travels, particularly for flight delays or other flight-related issues.

Under the Etiqa Travel Ezy plan, you automatically get RM60 in terms of compensation if your flight is delayed for more than 30 minutes.

There are no formal applications required. The money is automatically credited to your bank account within 24 hours of them being notified of your delayed flight.

As you can see, the range of travel insurance for those traveling within Malaysia and outside of Malaysia is extremely wide. There are plenty of options to choose from, with many travel insurance companies providing tailor-made options depending on what you need.

An Alternative Way to Purchase Travel Insurance: Airline Travel Insurance

While it is always best to purchase your travel insurance in Malaysia directly from insurance companies, there are some other ways in which you can purchase your travel insurance.

AirAsia, for example, has their own insurance company called Tune Protect.

Usually, when you are booking an AirAsia flight, they will ask you if you would like to purchase their travel insurance.

While other airlines may have the same feature, the travel insurance policy will usually be underwritten by an external insurance company.

AirAsia is rather unique in this sense.

This will also mean you can deal with any insurance-related inquiries, claims, or issues directly with the airline and they will be able to assist you accordingly.

The beautiful thing about the Tune Protect travel insurance plans is that they provide an incredibly wide range of options for almost every single type of travel.

Their plans include:

- Golf coverage

- Winter activities and sports coverage

- Adventure travel and activity coverage

- Gadget coverage

- Internal bus travel coverage for their Skybus which takes you from the airport into Kuala Lumpur city center and vice versa

As an airline, AirAsia is familiar with what travelers truly need. And as it can be seen, they definitely do their best to cater for them!

What to Look Out for When Buying Travel Insurance

It can be seen that there is no shortage of insurance providers, coverage, or plans when it comes to purchasing travel insurance.

That being said, when it comes to finalizing your insurance plan, keep in mind that your travel insurance documentation can be bulky and tedious to read.

However, it is absolutely vital for you to know exactly what you are covered for. So do take the time to read the relevant documents.

Here are some things to ensure that you are covered for under your travel insurance policy.

24-Hour Communication

This is extremely important, especially if you are traveling into different time zones.

You must be able to contact your travel insurance provider regardless of what time or day it is in Malaysia.

Accidents can happen at any time. The last thing you need is for your insurance provider to be unreachable during the time of a medical emergency.

This is especially true when the hospital has to call them to confirm the extent of your medical coverage under your travel insurance policy.

High Coverage Limits

Although healhcare costs in Malayia aren’t high in general, they can significantly add up when hospitalization, surgery, or medical evacuation are involved.

In addition, foreigners tend to be charged a higher amount than locals, like many countries in the world. This is especially so if you end up at a private healthcare facility.

As such, if you are a frequent traveler who dabbles in sports or extreme adventure activities, it is worth it to go with a more expensive travel insurance plan that provides a higher coverage limit and comes with extreme sports coverage for any medical expenses that you may incur.

One of those is WorldNomads.

With that, you can rest easy knowing that whatever the extent of your injuries, your treatment is covered until you can safely leave the hospital.

Emergency Medical Assistance & Emergency Evacuation

This is especially important if you tend to travel to remote places, go hiking out in the wild or engage in extreme adventure sports.

Emergency medical assistance and emergency evacuation are two distinct features of a travel insurance policy.

Emergency medical assistance means that your policy covers relevant medical personnel coming to your location to treat your injuries.

However, if you get seriously injured while high up on a mountain somewhere, merely treating the injury will not be sufficient.

You may require emergency evacuation facilities such as trained paramedics and a helicopter to airlift you from your location to the nearest hospital.

As such, it is important to ensure that both of these are covered by your travel insurance policy, depending on your specific needs and budget.

Worldwide Coverage

If Malaysia isn’t your sole destination, then there is no doubt that this should be a vital element of your travel insurance policy.

A quick glance at your insurance documentation will let you know which area or region your policy covers.

Your coverage and premium payments will depend on the region that your country falls into, as determined by the travel insurance provider.

It is important to ensure that your destination of choice is covered.

You don’t want to go through all the trouble and expense of purchasing travel insurance only to find out that you are in a country that is not covered by your travel insurance policy.

General Exclusions for Travel Insurance Policies

Most travel insurance policies have a list of general exclusions.

These are essentially circumstances that will not be covered by your travel insurance policy.

One of the main reasons for this is that travel insurance in Malaysia is relatively easy to obtain and is also relatively affordable.

As such, there are certain risks that travel insurance providers are not willing to take on or compensate travelers for.

Some of these are:

Pre-Existing Conditions

This is one of the main exclusions of most travel insurance providers and health insurance providers in Malaysia.

Pre-existing conditions refer to any illnesses or medical conditions that you may have at the time of purchasing your travel insurance coverage and policy.

For example, if you have a heart condition and you end up in hospital during your travels as a result of that heart condition, your travel insurance policy is unlikely to cover you for any medical expenses that stem directly from that heart condition.

At this juncture, it is important to remember that medical expenses under a travel insurance policy will only be covered if you are hospitalized as a result of something that occurred during your travel that has nothing to do with any pre-existing conditions that you may have.

Your pre-existing conditions may be covered by your existing medical insurance policy but it is unlikely that any hospitalization expenses that you may incur overseas will fall within the scope of the medical insurance policy.

This is another reason why it is worth it to take the time to read your insurance policy documents in great detail and properly understand the extent of any coverage limits that may apply in different situations.

Carelessness or Recklessness

Most travel insurance will not provide coverage for any loss, damage, injury, or expenses that may occur as a result of your carelessness or in the event you are reckless.

That being said, whether you have been careless or reckless will depend on whether the travel insurance provider views it as such. As a result of this, it will very much depend on a case-to-case basis.

For example, let’s say you are a digital nomad. You have now purchased specific travel insurance coverage for your gadgets such as your laptop, camera, and mobile phone.

In the event you leave any of these gadgets in a taxi or a bus, you will not be compensated for the value of the gadget. This is because the loss has occurred as a result of your carelessness.

However, if the vehicle you are in is involved in an accident of some kind and your gadgets get damaged, then it is likely that your travel insurance policy will cover the value of the gadgets in question up to the limit specified in your travel insurance policy document.

As such, when purchasing your travel insurance policy, it is important to remember that most travel insurance coverage types are only likely to cover losses that occur as a result of accidents or unforeseeable circumstances.

Other exclusions that most travel insurance plans in Malaysia have are any loss, injury, damage, or expenses sustained as a result of:

- War and other related risks such as riots or protests

- Suicide or any self-inflicted injuries

- Hazardous adventure or extreme sports (this is why you will need to buy additional coverage in most travel insurance policies if you participate in these kinds of activities)

- HIV, AIDS, or other conditions that are related to the same

- Engaging in drugs or alcohol

- Pregnancy, childbirth, abortion, or miscarriage

- Illness or disorders such as anxiety, depression, or any other mental health issues

Travel Insurance for Hajj and Umrah Pilgrimages

The Hajj pilgrimage is an extremely viral religious duty that must be carried out by all Muslims during specific dates in the last month of the Islamic calendar.

It involves traveling to Mecca, Saudi Arabia, which is the holiest city for Muslims.

With this in mind, plenty of travel insurance providers in Malaysia have come up with specific plans to cover any unforeseen events that may occur during this religious and spiritual experience.

Some travel insurance in Malaysia also provides for the Umrah pilgrimage. This is when the journey to Mecca is carried out at other times of the year.

With the Muslim-majority population in Malaysia, these travel insurance plans have become increasingly popular among travel insurance providers in Malaysia.

What is the Best Travel Insurance in Malaysia?

Because of the many travel insurance plans and providers out there, you’re probably wondering what the best travel insurance is in Malaysia.

Actually, there is no best plan out there. It is more about the plan that’s most suitable for you.

One plan that works best for others might not be good to you.

To give you an idea, those who plan to do extreme sports such as surfing, driving, and hiking should go for travel insurance plans that come with extreme sport coverage such as World Nomads.

On the other hand, if you only want to sightsee around cities in Malaysia and then fly to other countries, ACS Globe Traveller would be a better option.

Or if you keep moving from city to city all the time, then it might be easier to get a monthly plan from Safety Wings to make sure you are always protected.

How Much is Travel Insurance in Malaysia?

The cost of travel insurance in Malaysia depends on various factors such as:

- What is your required coverage?

- How old are you?

- What is your nationality?

- How long is your coverage period?

- What coverage limit do you want?

This means that the cost of travel insurance differs between each person because of the aforementioned factors.

It can be less than $1 a day or more than $5.

A recommended way to find out the cost of your own insurance is to first look at a type of travel insurance that you want.

Do you want comprehensive travel insurance that comes with high coverage limits to make sure you won’t need to pay anything out of pocket? Or do you only want to have basic travel insurance?

Once you know what you need, you can check at a travel insurance provider’s website to find your own quote.

Can I Still Buy Travel Insurance After Booking?

Yes, you are able to buy travel insurance after booking a flight or hotel.

The important part is that you need to get travel insurance at least a day before your departure date.

Even after the departure date, you can still get travel insurance from some providers such as SafetyWing. However, it might come with a waiting period before you can make a claim.

SafetyWing, for example, comes with a waiting period of 8 days.

Therefore, it’s still best to get travel insurance before your trip to make sure your entire trip is covered.

Now, on to You

I hope that this article answers everything you need to know when it comes to travel insurance in Malaysia.

Although travel insurance is optional, it is recommended to get it before your trip. This is to make sure you have some financial protection when something unexpected happens.

Travel insurance also gives you extra peace of mind. You know that when you run into a problem, the insurance company will pay for it.